An Introduction to Money Market Instruments

The money market is a well-established platform that allows participants to engage in the borrowing and lending of high-quality debt securities with a maturity of one year or less. It is designed to provide short-term financing solutions for governments, companies, banks, and other financial institutions while also offering individual investors a low-risk investment option. Some of the instruments traded in the money market include Treasury bills, certificates of deposit, commercial paper, bills of exchange, and short-term mortgage- and asset-backed securities.

Big corporations can access the money market directly through dealers while smaller companies can lend money through money market mutual funds. Individuals who wish to invest in the money market can do so through a money market bank account or a money market mutual fund, which is a professionally managed fund that invests in money market securities on behalf of its clients.

What is the Money Market and its Components?

The money market serves as a venue for lenders and borrowers to meet their short-term financing needs. It is a sector of the economy that provides short-term funds and deals in short-term loans, typically with a maturity of one year or less.

Given the popularity of short-term securities, the money market has become an important part of the economic market for assets involved in short-term borrowing, lending, buying, and selling with maturities of twelve months or less. Trading in the money market is usually conducted over-the-counter and is wholesale in nature.

There are a variety of money market instruments in Western countries, including Treasury bills, commercial paper, banker’s acceptances, deposits, certificates of deposit, bills of exchange, repurchase agreements, federal budget, and short-lived mortgage- and asset-backed securities. These instruments have different maturities, currencies, credit risks, and structures. A market is considered a money market if it is comprised of highly liquid, short-term assets. Money market funds typically invest in government securities, certificates of deposit, commercial paper, and other highly liquid, low-risk securities.

The money market is a crucial component of the global financial system, including capital markets, and is a part of the broader financial markets system. It provides liquidity for the financial system and is an important contributor to financial stability.

What is a Money Market Account?

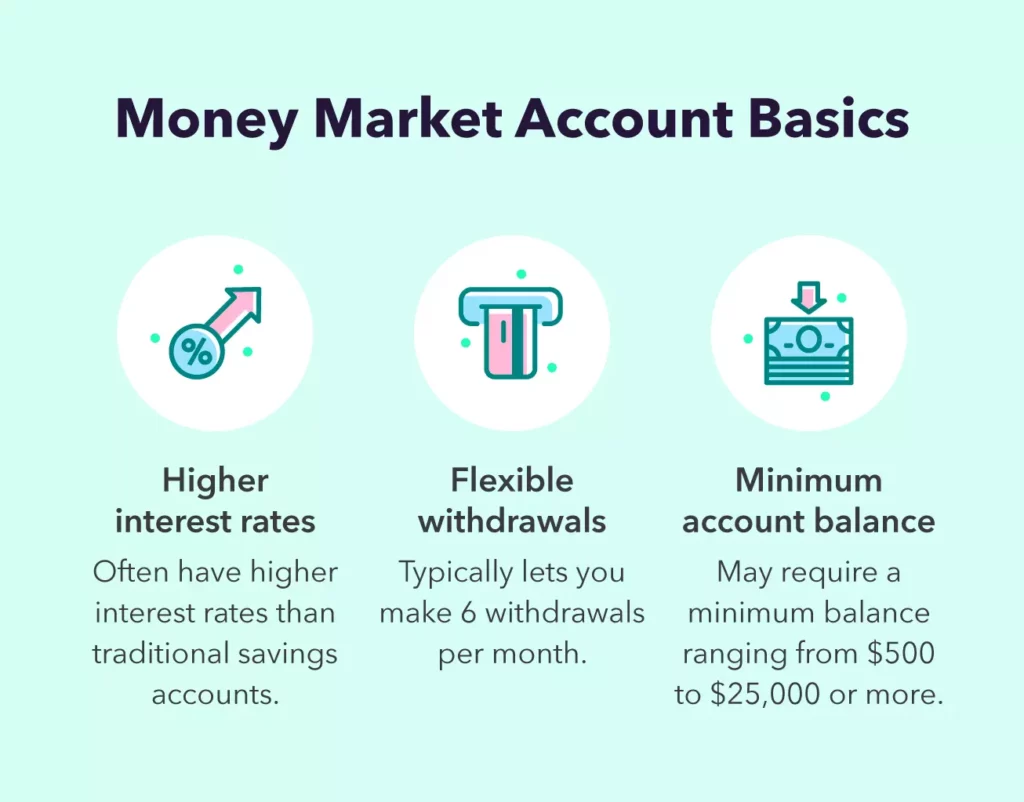

A money market account is a savings account that may also have debit card and check-writing privileges. The accounts usually limit the number of purchases and transfers to six each month, but ATM withdrawals are typically not capped.

Traditionally, money market accounts offered higher interest rates compared to regular savings accounts. However, these days, the rates are similar. Nevertheless, many MMAs have higher minimum deposit or balance requirements than regular savings accounts.

Deposits in money market accounts are insured by the Federal Deposit Insurance Corp. at banks and the National Credit Union Administration at credit unions. Your money is protected, up to $250,000 per depositor, in case the financial institution goes out of business.

Functions of the Money Market:

- Providing Liquidity: The primary function of the money market is to provide liquidity to individuals, businesses, and institutions. By lending and borrowing funds in the short-term, the money market helps to ensure that short-term funds are readily available.

- Reducing Financial Risk: The money market reduces financial risk by providing a safe haven for short-term investments. Since the investments in the money market are relatively low-risk, investors are able to reduce their exposure to financial risk.

- Facilitating Transactions: The money market also facilitates transactions by allowing individuals and institutions to trade short-term financial instruments. This allows for the transfer of funds from one entity to another, helping to ensure that there is always a supply of short-term funds available.

- Promoting Price Stability: The money market helps to promote price stability by ensuring that short-term funds are readily available. This helps to prevent a sudden increase in interest rates, which could have a negative impact on the economy.

- Encouraging Savings: The money market encourages savings by offering a safe and secure place for individuals and institutions to park their short-term funds. By investing in short-term instruments, individuals and institutions can earn a return on their savings while still having quick access to their funds if needed.

Money Market Instruments: Understanding the Basics

The money market is a segment of the financial market that deals with short-term borrowing and lending of funds, with a maturity of less than one year. This market plays a crucial role in providing liquidity to the financial system, allowing businesses, governments and other entities to meet their short-term funding needs. The instruments used in this market are referred to as money market instruments.

Types of Money Market Instruments

There are several types of money market instruments, including:

- Treasury bills: These are short-term debt securities issued by the government with a maturity of less than one year. They are considered to be a safe investment option as they are backed by the full faith and credit of the government.

- Commercial Paper: This is an unsecured, short-term debt instrument issued by corporations. It is used by companies to raise funds for their short-term financing needs, such as working capital or debt repayment.

- Certificates of Deposit (CDs): CDs are time deposits offered by banks and other financial institutions. They have a fixed interest rate and maturity date, and they are considered to be a low-risk investment option.

- Repurchase Agreements (Repos): Repos are short-term loans that are secured by government securities. They are used by financial institutions to raise funds in the short term and to manage their liquidity.

- Money Market Funds: Money market funds are mutual funds that invest in a diversified portfolio of money market instruments, such as Treasury bills, commercial paper, and CDs. They are considered to be a low-risk investment option and are often used by individuals and institutions as a safe haven for their cash reserves.

Instruments Traded in the Market

In the market, various types of financial instruments are traded. Some of these instruments include stocks, bonds, options, commodities, futures, and forex.

Stocks:

Stocks are a type of security that represents ownership in a corporation. They are bought and sold on the stock market, where the price of each stock is determined by supply and demand. Stockholders have a claim on the company’s earnings and assets.

Bonds:

Bonds are debt securities issued by corporations, municipalities, and government entities. They pay periodic interest to the bondholder and return the bond’s face value upon maturity. The price of a bond is determined by interest rates, credit risk, and the issuer’s financial standing.

Options:

Options are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain period of time. The holder pays a premium to the option writer for this right. Options are widely used for hedging, speculation, and income generation.

Commodities:

Commodities are physical goods such as metals, energy sources, and agricultural products. They are traded in the futures market, where buyers and sellers agree to purchase or sell a commodity at a set price and delivery date in the future.

Futures:

Futures are contracts between two parties to buy or sell an underlying asset at a set price and delivery date in the future. These are commonly used for hedging, speculation, and price discovery.

Forex:

Forex is the market for trading currencies. Participants buy and sell currencies for speculation, hedging, and to facilitate international trade and investment. The price of a currency is determined by supply and demand, and influenced by economic, political, and other factors.

In conclusion, the market offers a wide range of financial instruments for investors and traders to choose from. Understanding the different types of instruments and how they work can help you make informed investment decisions.

Benefits of Money Market Instruments

- Safety: Money market instruments are considered to be relatively safe investments compared to other types of financial instruments, such as stocks or bonds. They are backed by the full faith and credit of the government, or they are secured by high-quality assets, making them a low-risk investment option.

- Liquidity: Money market instruments are highly liquid, meaning that they can be easily converted into cash. This is especially important for individuals and institutions that need to manage their short-term funding needs.

- High Yields: Money market instruments often offer higher yields compared to savings accounts or other low-risk investment options, making them an attractive option for individuals and institutions looking to maximize their returns on their cash reserves.

FAQ Section:

- What is the money market?

The money market is a sector of the financial market that deals with short-term borrowing and lending of funds. It provides liquidity and stability to the financial system by allowing individuals and institutions to trade short-term financial instruments. - What are the functions of the money market?

The functions of the money market include providing liquidity, reducing financial risk, facilitating transactions, promoting price stability, and encouraging savings. - What are some examples of money market instruments?

Examples of money market instruments include Treasury bills, commercial paper, certificates of deposit, and repurchase agreements. - Is investing in the money market safe?

Investing in the money market is considered relatively safe compared to other forms of investment. However, it is important to research and understand the financial instruments before making an investment. - Who can invest in the money market?

Individuals, businesses, and institutions can invest in the money market. Some money market funds may have restrictions on who can invest, so it is important to research and understand the specific fund before making an investment.

Conclusion

Money market instruments play a crucial role in the financial system, providing a source of short-term financing and liquidity. They are considered to be low-risk investments and are often used by individuals and institutions as a safe haven for their cash reserves. With the various types of money market instruments available, it is important to carefully consider your investment objectives, risk tolerance, and other factors before making any investment decisions.

This was an complete guide to money market. Read about the best stock market formula the Contribution Margin Formula. Also, check out other more informative content Insights by InveShares here. Happy Investing, Happy Life!

Reference Section:

- Federal Reserve Bank of St. Louis. (2021). Money Market. Retrieved from https://fred.stlouisfed.org/categories/38

- Investopedia. (2021). Money Market. Retrieved from https://www.investopedia.com/terms

- U.S. Securities and Exchange Commission. (2021). Money Market Funds. Retrieved from https://www.sec.gov/investor/pubs/mmf.htm