Introduction to Deep Value Investing:

- Definition of deep value investing

- Explanation of why deep value investing can be a good strategy for long-term investment success

- A brief overview of the history of deep value investing and some famous deep value investors

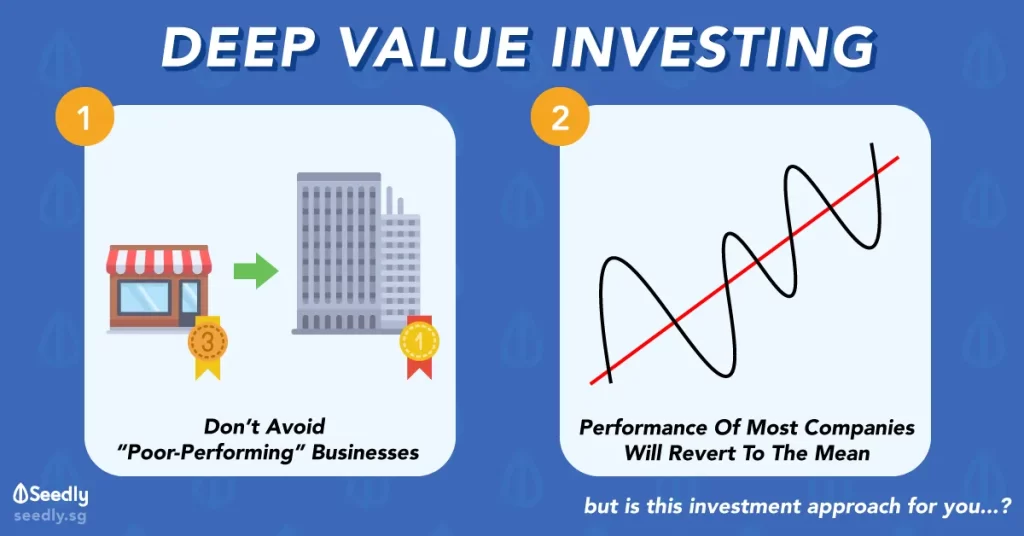

Deep value investing is a long-term investment strategy that focuses on seeking out undervalued assets and companies that are trading at a significant discount to their intrinsic value. This approach to investing is based on the belief that the market often misprices certain assets or companies, and that by identifying these mispricings, investors can achieve significant returns over time. Some famous proponents of deep value investing include Warren Buffett, Benjamin Graham, and Charlie Munger, who have all achieved remarkable success using this approach. By taking a disciplined and patient approach to investing, and by following the principles of deep value investing, investors can potentially uncover hidden gems in the market and achieve long-term investment success.

One of the key principles of deep value investing is the idea of margin of safety. This refers to the difference between the intrinsic value of a stock and its current market price. Deep value investors aim to buy stocks with a large margin of safety, which provides a buffer against potential downside risk. By purchasing stocks that are significantly undervalued, deep value investors hope to minimize their risk and maximize their potential for long-term gains.

The Principles of Deep Value Investing

- A discussion of the key principles that drive deep value investing, such as seeking out undervalued assets, avoiding overhyped or overpriced investments, and looking for “hidden” value in overlooked or underappreciated companies

- Tips and guidelines for identifying deep-value investment opportunities

- Seek out undervalued assets: Deep value investors look for companies that are trading at a significant discount to their intrinsic value. This may involve looking for companies that are temporarily out of favor with the market, or those that have been overlooked by other investors.

- Avoid overhyped or overpriced investments: Deep value investors strive to avoid overvalued or overhyped investments, as they believe these stocks are more likely to underperform in the long run.

- Look for “hidden” value: Deep value investors often look for value in overlooked or underappreciated companies. This may involve searching for companies in niche industries, or those with strong underlying assets that are not reflected in their current market price.

Here are some tips and guidelines for identifying deep value investment opportunities:

Research and analyze a company’s financials: Deep value investors typically conduct thorough research and analysis of a company’s financial statements and other financial data to determine its intrinsic value. This may involve looking at metrics such as price-to-earnings ratio, price-to-book ratio, and debt-to-equity ratio.

Look for companies with strong underlying assets: Deep value investors often look for companies with strong underlying assets, such as a strong brand, a loyal customer base, or proprietary technology. These assets can help to provide a cushion against potential market fluctuations.

Consider the company’s management team: A strong management team can be an important factor in a company’s long-term success. Deep value investors may look for companies with experienced and capable management teams.

The Risks And Rewards Of Deep Value Investing:

- A discussion of the potential risks and rewards of deep value investing, including the possibility of investing in distressed or underperforming companies and the potential for significant returns if the company’s value is eventually recognized by the market

- Strategies for mitigating the risks of deep value investing, such as diversifying your portfolio and being patient

A discussion of the potential risks and rewards of deep value investing, including the possibility of investing in distressed or underperforming companies and the potential for significant returns if the company’s value is eventually recognized by the market Strategies for mitigating the risks of deep value investing, such as diversifying your portfolio and being patient.

- Investing in distressed or underperforming companies: By definition, deep value investing involves buying stocks that are trading at a significant discount to their intrinsic value. This means that deep value investors may be more likely to invest in distressed or underperforming companies that are out of favor with the market.

- Long holding periods: Deep value investing requires a patient, long-term approach. It may take time for the market to recognize the true value of an undervalued company, and investors may need to hold onto their investments for an extended period of time before realizing any significant returns.

However, there is also the potential for significant rewards if the company’s value is eventually recognized by the market. By buying stocks at a discount, deep value investors have the potential to achieve higher returns than they would if they had purchased the stock at its full intrinsic value.

Case Studies of Successful Deep Value Investments:

- Examples of successful deep value investments made by famous deep value investors, such as Warren Buffett or Benjamin Graham

- Explanation of the reasoning behind these successful investments and how they fit into the principles of deep value investing

- Warren Buffett: One of the most well-known deep value investors, Warren Buffett is known for his focus on buying undervalued companies with strong underlying assets and long-term growth potential. One of his most famous deep value investments was his purchase of American Express in the 1960s. At the time, the company was facing a crisis due to the failure of its finance subsidiary, but Buffett believed in the strength of the American Express brand and its long-term growth potential. He eventually made a profit of over $1 billion on the investment.

- Benjamin Graham: Benjamin Graham is often considered the father of value investing, and his principles have influenced many deep value investors. One of his most famous deep value investments was his purchase of the Northern Pipeline Company in the 1930s. Graham believed that the company’s assets were significantly undervalued, and he eventually made a profit of over $20 million on the investment.

Both of these examples fit into the principles of deep value investing, as they involved buying undervalued companies with strong underlying assets and the potential for long-term growth. Both Buffett and Graham also exhibited patience and a long-term investment horizon, as they held onto their investments for an extended period of time before realizing significant returns.

Conclusion

- A summary of the main points of the blog post

- A discussion of the potential benefits of incorporating deep value investing into your overall investment strategy

- Encouragement for readers to do further research and consider adding investments to their portfolio.

In summary, deep value investing is a strategy that involves buying stocks that are trading at a significant discount to their intrinsic value. It requires a patient, long-term approach and a thorough understanding of a company’s financials and competitive landscape. carries its own set of risks, such as the possibility of investing in distressed or underperforming companies, but also has the potential for significant rewards if the company’s value is eventually recognized by the market.

There are several potential benefits to incorporating investing into your overall investment strategy. By buying stocks at a discount, you have the potential to achieve higher returns than you would if you had purchased the stock at its full intrinsic value. investing also allows you to capitalize on market inefficiencies and potentially outperform the overall market.

If you are interested in adding to your portfolio, it is important to do further research and carefully consider the potential risks and rewards. It may also be helpful to seek the advice of a financial advisor or professional investment manager. With careful research and a long-term investment horizon, investing can be a powerful tool for achieving long-term investment success.

Keep Following InveShares for more such awesome content right here!