Table of Contents : Dow Jones Stocks

- Introduction To Dow Jones Stocks

- Understanding Dow Jones

- The Significance of Dow Jones Stocks

- Factors Influencing Dow Jones Stocks

- Top Dow Jones Stocks to Watch in 2024

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- The Goldman Sachs Group, Inc. (GS)

- Boeing Company (BA)

- Johnson & Johnson (JNJ)

- Visa Inc. (V)

- JPMorgan Chase & Co. (JPM)

- Procter & Gamble Company (PG)

- Walt Disney Company (DIS)

- American Express Company (AXP)

- Coca-Cola Company (KO)

- Intel Corporation (INTC)

- The Home Depot, Inc. (HD)

- Pfizer Inc. (PFE)

- Cisco Systems, Inc. (CSCO)

- Nike, Inc. (NKE)

- Verizon Communications Inc. (VZ)

- Chevron Corporation (CVX)

- International Business Machines Corporation (IBM)

- UnitedHealth Group Incorporated (UNH)

- Conclusion

- FAQs

Introduction : Dow Jones Stocks

Investing in stocks can be a lucrative venture, but it requires careful consideration and research. In 2024, many investors are keeping a close eye on the Dow Jones Industrial Average, which is a key indicator of the overall health of the U.S. stock market. This comprehensive guide will explore the top Dow Jones stocks to watch in 2024, providing insights into their performance, potential, and the factors that influence their prices.

Understanding Dow Jones

Before delving into the specific stocks, it’s essential to understand what Dow Jones is. Dow Jones refers to the Dow Jones Industrial Average (DJIA), which is one of the most widely recognized stock market indices globally. It was created by Charles Dow and is maintained by S&P Dow Jones Indices, a division of S&P Global.

The Significance of Dow Jones Stocks

Dow Jones stocks hold immense significance for both individual and institutional investors. They are often used as a benchmark to gauge the performance of the broader stock market. When Dow Jones stocks perform well, it’s generally seen as a positive sign for the economy. Conversely, poor performance in these stocks can signal economic instability.

Factors Influencing Dow Jones Stocks

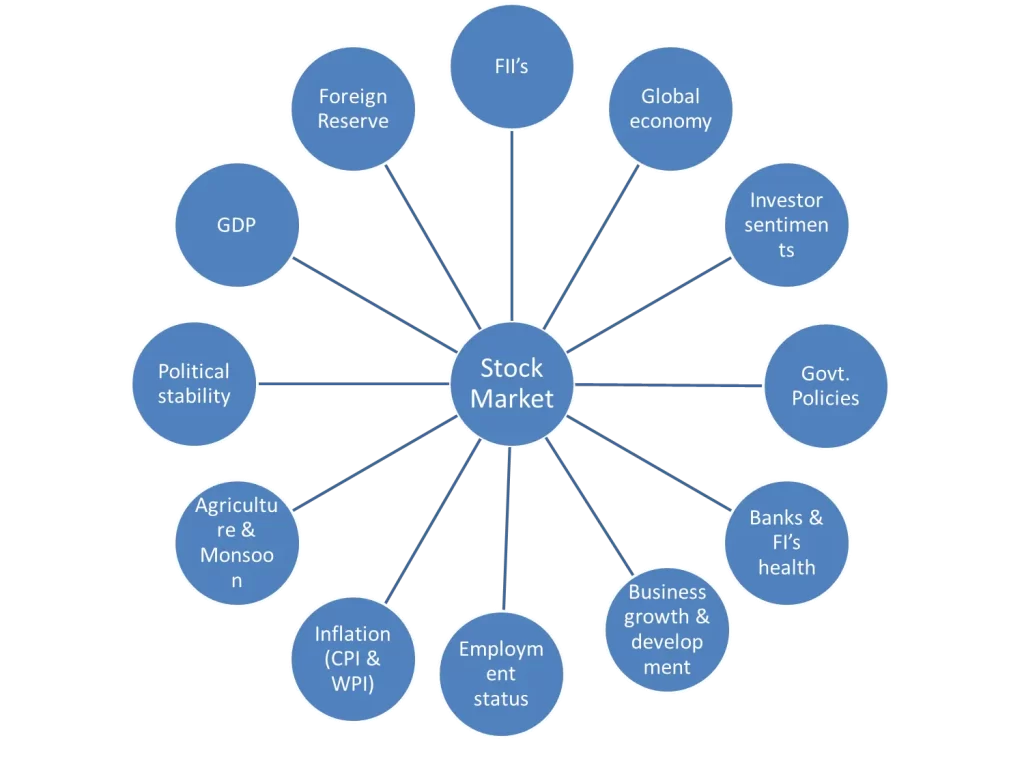

Several factors influence the prices of Dow Jones stocks, and understanding these factors is crucial for investors. Some of the key factors include:

- Economic Data: Economic indicators such as GDP growth, unemployment rates, and inflation can impact Dow Jones stocks.

- Corporate Earnings: The financial performance of companies within the DJIA can significantly affect stock prices.

- Interest Rates: Changes in interest rates by central banks can impact borrowing costs for businesses, influencing stock prices.

- Global Events: Events such as geopolitical tensions and natural disasters can affect investor sentiment and stock markets.

Now, let’s delve into the top Dow Jones stocks to watch in 2024, exploring why it may be a good time to invest in each of them.

Top Dow Jones Stocks to Watch in 2024

In 2024, several Dow Jones stocks stand out as potential investment opportunities. These companies have shown resilience and adaptability in the face of economic challenges and are poised for growth. Here are the top Dow Jones stocks to keep a close eye on:

1. Apple Inc. (AAPL)

Why Invest in Apple Inc. (AAPL) in 2024:

Apple Inc. continues to be a powerhouse in the technology sector. With a market-leading position in smartphones, tablets, and computers, Apple is poised to benefit from the ongoing digital transformation. The release of new products and services, including the iPhone 14 and Apple’s expansion into the services sector with offerings like Apple TV+ and Apple Arcade, indicates a commitment to innovation and diversification.

Furthermore, Apple’s strong financials, including a healthy balance sheet and robust cash reserves, provide stability for investors. The company’s dividend payments are attractive for income-focused investors, and its stock buyback program demonstrates confidence in its own growth prospects.

In 2024, the increased demand for tech products and the continued growth of Apple’s ecosystem make it a compelling choice for investors seeking exposure to the technology sector.

2. Microsoft Corporation (MSFT)

Why Invest in Microsoft Corporation (MSFT) in 2024:

Microsoft Corporation is a tech giant with a diversified portfolio of products and services, making it an attractive investment option in 2024. The company’s cloud computing division, Azure, has experienced robust growth, driven by the increasing adoption of remote work and digital transformation.

Microsoft’s Office 365 suite remains a staple in businesses worldwide, and its acquisition of LinkedIn adds to its professional networking and software capabilities. With a focus on artificial intelligence and machine learning, Microsoft is positioned to capitalize on emerging technologies.

Additionally, Microsoft’s commitment to sustainability and renewable energy initiatives aligns with the growing emphasis on environmental responsibility in the corporate world, potentially attracting environmentally conscious investors.

In 2024, Microsoft’s resilience, diverse product offerings, and emphasis on innovation make it a strong contender for investment.

3. The Goldman Sachs Group, Inc. (GS)

Why Invest in The Goldman Sachs Group, Inc. (GS) in 2024:

The Goldman Sachs Group, Inc. is a renowned investment banking and financial services company with a global presence. In 2024, it stands out as an investment option due to its expertise in finance and investment management.

Goldman Sachs has a history of adapting to changing market conditions, and its ability to provide a wide range of financial services, including investment banking, asset management, and trading, positions it as a key player in the financial sector.

With the potential for increased merger and acquisition activity and the resurgence of IPOs, investment banks like Goldman Sachs are expected to play a vital role in facilitating these transactions. Additionally, the low-interest-rate environment can lead to increased demand for financial services.

Investors looking to capitalize on potential economic recovery and financial market activity in 2024 may find Goldman Sachs an attractive choice.

4. Boeing Company (BA)

Why Invest in Boeing Company (BA) in 2024:

Despite recent challenges, the Boeing Company remains a significant player in the aerospace and defense industries. In 2024, there are several reasons to consider investing in Boeing.

Firstly, the global aviation industry is expected to rebound as travel restrictions ease and demand for air travel returns. Boeing, as a leading manufacturer of commercial aircraft, is well-positioned to benefit from this recovery.

Secondly, Boeing’s defense segment continues to thrive, with contracts for military aircraft and defense systems. This diversification provides stability in uncertain times.

Lastly, Boeing’s commitment to innovation, including the development of the 737 MAX and advancements in sustainable aviation, demonstrates its dedication to staying competitive in the long term.

While there may be short-term challenges, Boeing’s role in shaping the future of aviation makes it an intriguing investment option in 2024.

5. Johnson & Johnson (JNJ)

Why Invest in Johnson & Johnson (JNJ) in 2024:

Johnson & Johnson is a pharmaceutical and consumer goods conglomerate known for its healthcare products. It is a compelling investment choice in 2024 for several reasons.

Firstly, Johnson & Johnson’s diverse product portfolio includes pharmaceuticals, medical devices, and consumer health products. This diversification provides stability and reduces reliance on a single market segment.

Secondly, the company’s pharmaceutical division has a robust pipeline of drugs, including those related to oncology and immunology, which can drive future growth.

Thirdly, Johnson & Johnson’s involvement in COVID-19 vaccine development and distribution underscores its role in addressing global health challenges.

Lastly, the company has a history of steady performance and consistent dividend payouts, making it attractive for income-focused investors.

In 2024, Johnson & Johnson’s position in the healthcare sector and its commitment to innovation make it an attractive investment.

6. Visa Inc. (V)

Why Invest in Visa Inc. (V) in 2024:

Visa Inc. is a global payments technology company, and it presents a compelling investment opportunity in 2024 due to the continued rise of digital payments.

The shift from cash to digital payments has accelerated, driven by the COVID-19 pandemic. Visa’s extensive payment network and technology infrastructure are well-positioned to benefit from this trend. As more consumers and businesses embrace e-commerce and contactless payments, Visa stands to gain.

Visa’s financial performance remains strong, with a history of revenue growth and profitability. The company’s global reach and partnerships with financial institutions further solidify its position in the payments industry.

Additionally, Visa’s foray into cryptocurrency and blockchain technology demonstrates its adaptability to emerging financial technologies.

Investors seeking exposure to the expanding digital payments landscape may find Visa an attractive choice in 2024.

7. JPMorgan Chase & Co. (JPM)

Why Invest in JPMorgan Chase & Co. (JPM) in 2024:

JPMorgan Chase & Co. is a leading financial institution that provides a range of banking and financial services. In 2024, it offers a compelling investment case for several reasons.

Firstly, the potential for increased economic activity and lending in a post-pandemic environment can benefit banks like JPMorgan Chase. The easing of restrictions and fiscal stimulus measures may drive loan demand.

Secondly, JPMorgan Chase’s diversified operations, including consumer banking, investment banking, and asset management, provide multiple revenue streams and reduce risk.

Thirdly, the company’s strong financial position, including a solid balance sheet and capital reserves, instills confidence in its ability to weather economic uncertainties.

Lastly, JPMorgan Chase’s commitment to digital banking and fintech partnerships positions it to thrive in an evolving financial landscape.

In 2024, JPMorgan Chase’s stability and adaptability make it a noteworthy investment option.

8. Procter & Gamble Company (PG)

Why Invest in Procter & Gamble Company (PG) in 2024:

The Procter & Gamble Company, known for its consumer goods brands, offers an appealing investment opportunity in 2024.

Firstly, Procter & Gamble’s portfolio includes well-known brands in categories like healthcare, personal care, and household products. These products have maintained demand, making the company relatively recession-resistant.

Secondly, the company’s commitment to innovation and sustainability aligns with changing consumer preferences and environmental concerns.

Thirdly, Procter & Gamble has a history of consistent performance and dividend payments, making it attractive for income-focused investors.

In a year marked by economic uncertainty, Procter & Gamble’s defensive qualities and established market presence make it a sound investment choice.

9. Walt Disney Company (DIS)

Why Invest in Walt Disney Company (DIS) in 2024:

The Walt Disney Company is a household name in the entertainment industry, and it presents an intriguing investment opportunity in 2024.

Firstly, Disney’s diverse portfolio includes media networks, theme parks, and content streaming services like Disney+. The growth of Disney+ and the release of new content bolster the company’s position in the streaming wars.

Secondly, as travel and leisure activities rebound, Disney’s theme parks and resorts segment is expected to recover, contributing to revenue growth.

Lastly, Disney’s strong brand and intellectual property assets provide a competitive advantage in the entertainment market.

Investors looking for exposure to the entertainment and media sector in 2024 may find Disney an appealing choice.

10. American Express Company (AXP)

Why Invest in American Express Company (AXP) in 2024:

American Express Company, a financial services company known for its credit card products and financial solutions, offers an attractive investment opportunity in 2024.

Firstly, as consumer spending rebounds, credit card companies like American Express stand to benefit. The company’s strong brand and premium card offerings make it well-positioned in the market.

Secondly, American Express’s focus on digital payment solutions and mobile banking aligns with evolving consumer preferences.

Lastly, the company’s history of profitability and dividend payments makes it appealing for income-focused investors.

In a post-pandemic world, American Express’s role in facilitating consumer spending and its commitment to technological innovation make it a noteworthy investment choice.

11. Coca-Cola Company (KO)

Why Invest in Coca-Cola Company (KO) in 2024:

The Coca-Cola Company is a global beverage giant known for its strong presence in the soft drink market. It offers a compelling investment opportunity in 2024 for several reasons.

Firstly, Coca-Cola’s iconic brands, including Coca-Cola, Sprite, and Dasani, maintain their popularity, providing stability in revenue.

Secondly, the company’s diversification into non-carbonated beverages and healthier alternatives aligns with changing consumer preferences.

Thirdly, Coca-Cola’s global reach and distribution network position it to capitalize on emerging markets and trends.

Lastly, the company has a history of consistent performance and dividend payments, making it an appealing option for income-focused investors.

In a year marked by shifting consumer preferences, Coca-Cola’s established brand and adaptability make it a sound investment choice.

12. Intel Corporation (INTC)

Why Invest in Intel Corporation (INTC) in 2024:

Intel Corporation, a technology company known for its microprocessors and semiconductor products, remains a key player in the tech industry and offers an intriguing investment opportunity in 2024.

Firstly, the global demand for technology products and services continues to rise, and Intel’s role in providing essential components for computers and data centers positions it for growth.

Secondly, Intel’s commitment to research and development ensures that it stays competitive in the rapidly evolving tech landscape.

Lastly, the company’s strong financials, including cash reserves and dividend payments, provide stability for investors.

In a year marked by increased reliance on technology, Intel’s foundational role in the industry makes it an appealing investment option.

15. The Home Depot, Inc. (HD)

Why Invest in The Home Depot, Inc. (HD) in 2024:

The Home Depot, Inc. is a leading home improvement retailer, and it presents an attractive investment opportunity in 2024.

Firstly, the booming housing market and increased interest in home improvement projects amid the COVID-19 pandemic have driven demand for home improvement products. The Home Depot stands to benefit from this trend.

Secondly, the company’s commitment to digital transformation and e-commerce positions it to capture online sales growth.

Lastly, The Home Depot’s financial stability and dividend payments make it appealing for income-focused investors.

As consumers continue to invest in their homes, The Home Depot’s strong market position and adaptability to changing consumer preferences make it a compelling choice for investors in 2024.

16. Pfizer Inc. (PFE)

Why Invest in Pfizer Inc. (PFE) in 2024:

Pfizer Inc., a pharmaceutical company known for its COVID-19 vaccine development, offers an intriguing investment opportunity in 2024.

Firstly, the global need for vaccines and pharmaceutical solutions remains high, and Pfizer’s experience in vaccine development positions it as a key player in public health.

Secondly, Pfizer’s diverse portfolio of pharmaceutical products extends beyond vaccines, contributing to revenue stability.

Lastly, the company’s commitment to research and development ensures ongoing innovation and competitiveness in the pharmaceutical industry.

As the world continues to address healthcare challenges, Pfizer’s contributions and pharmaceutical expertise make it a noteworthy investment choice in 2024.

17. Cisco Systems, Inc. (CSCO)

Why Invest in Cisco Systems, Inc. (CSCO) in 2024:

Cisco Systems, Inc. is a technology conglomerate specializing in networking hardware and software, and it presents a compelling investment opportunity in 2024.

Firstly, the demand for networking solutions and digital infrastructure remains strong as businesses adapt to remote work and digital transformation.

Secondly, Cisco’s commitment to cybersecurity and cloud computing aligns with the evolving needs of the tech industry.

Lastly, the company’s financial stability and history of providing essential networking solutions make it a reliable choice for investors.

In a tech-driven world, Cisco’s foundational role in networking and connectivity makes it an attractive investment option.

18. Nike, Inc. (NKE)

Why Invest in Nike, Inc. (NKE) in 2024:

Nike, Inc. is a global leader in athletic footwear and apparel, and it offers an enticing investment opportunity in 2024.

Firstly, Nike’s strong brand presence and athlete endorsements maintain its appeal among consumers, driving demand for its products.

Secondly, the company’s digital strategy, including e-commerce and direct-to-consumer channels, positions it for online sales growth.

Lastly, Nike’s commitment to sustainability and responsible business practices resonates with environmentally conscious consumers.

In a year marked by increased focus on health and wellness, Nike’s position in the athletic apparel market and adaptability to changing consumer preferences make it a compelling choice for investors.

19. Verizon Communications Inc. (VZ)

Why Invest in Verizon Communications Inc. (VZ) in 2024:

Verizon Communications Inc. is a telecommunications giant providing wireless and broadband services, and it offers an attractive investment opportunity in 2024.

Firstly, the demand for reliable telecommunications services remains strong as remote work, online education, and digital connectivity become increasingly vital.

Secondly, Verizon’s commitment to 5G technology positions it at the forefront of the next generation of wireless communication.

Lastly, the company’s history of stability and dividend payments makes it appealing for income-focused investors.

As the world becomes more connected, Verizon’s essential role in telecommunications and its focus on innovation make it a noteworthy investment choice.

20. Chevron Corporation (CVX)

Why Invest in Chevron Corporation (CVX) in 2024:

Chevron Corporation is a major player in the energy sector, with interests in oil and gas exploration, and it presents an intriguing investment opportunity in 2024.

Firstly, the recovery of oil prices and increased energy demand as economies reopen can benefit Chevron’s upstream operations.

Secondly, the company’s commitment to sustainable energy solutions and low-carbon initiatives aligns with changing environmental expectations.

Lastly, Chevron’s financial strength, including a strong balance sheet, positions it to navigate the challenges of the energy industry.

In a year marked by evolving energy dynamics, Chevron’s role in energy production and its focus on sustainability make it a compelling choice for investors.

21. International Business Machines Corporation (IBM)

Why Invest in International Business Machines Corporation (IBM) in 2024:

International Business Machines Corporation, known as IBM, is a technology company specializing in enterprise solutions and services. It offers an appealing investment opportunity in 2024.

Firstly, IBM’s expertise in cloud computing, artificial intelligence, and blockchain technology positions it as a key player in digital transformation.

Secondly, the company’s focus on hybrid cloud solutions addresses the evolving needs of businesses in a post-pandemic environment.

Lastly, IBM’s long history of technological innovation and global reach make it a reliable choice for investors seeking exposure to the tech sector.

In a world increasingly reliant on digital solutions, IBM’s role in technology infrastructure and its commitment to innovation make it a noteworthy investment option.

22. UnitedHealth Group Incorporated (UNH)

Why Invest in UnitedHealth Group Incorporated (UNH) in 2024:

UnitedHealth Group Incorporated is a diversified healthcare company offering insurance and healthcare services, and it presents a compelling investment opportunity in 2024.

Firstly, the demand for healthcare services and insurance remains steady, making UnitedHealth Group a stable choice in uncertain times.

Secondly, the company’s Optum segment, which provides health services and technology, contributes to its growth potential.

Lastly, UnitedHealth Group’s strong financials, including consistent revenue growth and dividend payments, make it appealing for income-focused investors.

In a year marked by health concerns and the importance of healthcare access, UnitedHealth Group’s role in the healthcare ecosystem and its financial strength make it an attractive investment option.

Conclusion

Investing in Dow Jones stocks can be a rewarding venture in 2024, as many of these companies have shown resilience, adaptability, and growth potential. While the specific reasons for investing in each company may vary, the overall outlook for these top Dow Jones stocks is positive.

In a dynamic market, staying informed and adapting to changing circumstances is crucial for successful investing. Keep an eye on economic indicators, corporate earnings reports, and global events that can impact Dow Jones stocks. By staying informed and making informed decisions, you can navigate the world of investing with us right here.

FAQs

1. How can I start investing in Dow Jones stocks in 2024?

Investing in Dow Jones stocks requires opening a brokerage account, conducting research, and making informed investment decisions. It’s advisable to consult with a financial advisor to create a personalized investment strategy.

2. What are the key factors to consider before investing in Dow Jones stocks?

Before investing, consider your financial goals, risk tolerance, and investment horizon. Additionally, research the specific companies you’re interested in, review their financial reports, and stay updated on market trends.

3. Are Dow Jones stocks considered safe investments in 2024?

While Dow Jones stocks are generally considered relatively safe due to their stability and market position, all investments carry some level of risk. It’s essential to diversify your portfolio and conduct thorough research before investing.

4. How can I stay updated on the performance of Dow Jones stocks?

You can stay updated by following financial news outlets, using stock market tracking apps, and regularly reviewing the performance of your investments on your brokerage platform.

5. What is the historical performance of Dow Jones stocks in previous years?

Dow Jones stocks have shown historical resilience and have provided long-term growth for investors. However, past performance is not indicative of future results, and market conditions can vary.

6. Are dividend payments common among Dow Jones stocks?

Yes, many Dow Jones stocks are known for their consistent dividend payments. Dividend stocks can provide a steady income stream for investors.

7. How can I mitigate risks when investing in Dow Jones stocks?

Diversifying your portfolio, conducting thorough research, and staying informed about market trends are effective ways to mitigate risks when investing in Dow Jones stocks.

8. Are there any tax implications to consider when investing in Dow Jones stocks?

Yes, capital gains from stock investments may be subject to taxation. It’s advisable to consult with a tax professional or financial advisor to understand the tax implications specific to your situation.

9. Can I invest in Dow Jones stocks through a retirement account, such as an IRA or 401(k)?

Yes, you can invest in Dow Jones stocks through retirement accounts like IRAs and 401(k)s. These accounts offer tax advantages and can be a valuable part of your long-term investment strategy.

10. What is the outlook for Dow Jones stocks in 2024?

While the specific outlook for Dow Jones stocks can vary by company and market conditions, many of these stocks have shown resilience and growth potential in 2024. It’s essential to conduct individual research and consider your investment goals when making decisions.

11. How can I access real-time stock market data for Dow Jones stocks?

You can access real-time stock market data through financial news websites, stock market apps, and brokerage platforms. These platforms provide up-to-the-minute information on stock prices, trends, and news.

12. Are there any risks associated with investing in technology companies like Apple and Microsoft in 2024?

Investing in technology companies carries specific risks related to technological advancements, market competition, and changing consumer preferences. It’s crucial to assess these risks and consider your risk tolerance before investing.

13. Can I invest in Dow Jones stocks with a limited budget?

Yes, it’s possible to invest in Dow Jones stocks with a limited budget. Many brokerage platforms offer fractional shares, allowing you to invest in high-priced stocks with smaller amounts of money.

14. How can I create a diversified portfolio of Dow Jones stocks in 2024?

To create a diversified portfolio, consider investing in a mix of companies from different sectors and industries represented in the Dow Jones Industrial Average. This can help spread risk and potentially enhance returns.

15. What is the significance of economic indicators when investing in Dow Jones stocks?

Economic indicators, such as GDP growth, unemployment rates, and inflation, can provide insights into the overall health of the economy and influence investor sentiment. Monitoring these indicators can help investors make informed decisions.

16. How can I stay informed about corporate earnings reports of Dow Jones companies?

Corporate earnings reports are typically published quarterly by publicly traded companies. You can access these reports on the companies’ investor relations websites or through financial news sources.

17. Is it advisable to invest in healthcare companies like Johnson & Johnson in 2024?

Investing in healthcare companies can be advisable, but it depends on your investment goals and risk tolerance. Healthcare companies like Johnson & Johnson have shown resilience and stability, making them attractive options for certain investors.

18. What are the potential risks associated with investing in the energy sector, such as Chevron, in 2024?

The energy sector can be influenced by factors such as oil prices, environmental regulations, and geopolitical tensions. Potential risks include price volatility and regulatory changes. It’s important to assess these risks before investing.

19. How can I assess the long-term growth prospects of technology companies like IBM in 2024?

Assessing the long-term growth prospects of technology companies involves analyzing their product innovation, market positioning, and ability to adapt to industry trends. Conducting thorough research and staying updated on their developments is essential.

20. Are there any opportunities for sustainable investing among Dow Jones stocks in 2024?

Yes, several Dow Jones companies are actively engaged in sustainability and environmental initiatives. Investors interested in sustainable investing can research companies’ sustainability practices and consider ESG (Environmental, Social, and Governance) factors when making investment decisions.

21. What are the advantages of investing in consumer goods companies like Procter & Gamble in 2024?

Investing in consumer goods companies can provide stability due to consistent demand for everyday products. Companies like Procter & Gamble offer the advantage of brand recognition and a history of dependable performance.

22. How can I evaluate the growth potential of entertainment companies like Disney in 2024?

Evaluating the growth potential of entertainment companies involves assessing their content pipelines, streaming platform growth, and expansion into new markets. Factors like subscriber numbers and content quality can indicate growth prospects.

23. Are there any risks associated with investing in financial institutions like JPMorgan Chase in 2024?

Investing in financial institutions carries risks related to economic downturns, regulatory changes, and interest rate fluctuations. It’s important to consider these risks and conduct due diligence before investing.

24. Can I invest in telecommunications companies like Verizon for both income and growth in 2024?

Yes, telecommunications companies like Verizon often offer both income, through dividends, and the potential for stock price appreciation. Verizon’s strong market position and commitment to 5G technology can contribute to growth potential.

25. How can I assess the potential impact of global events on Dow Jones stocks in 2024?

Assessing the impact of global events on Dow Jones stocks requires staying informed about geopolitical developments, trade policies, and economic trends. These factors can influence investor sentiment and stock market performance.

26. Can I invest in Dow Jones stocks for retirement planning in 2024?

Yes, many investors include Dow Jones stocks in their retirement portfolios. It’s advisable to create a diversified retirement portfolio that aligns with your long-term financial goals and risk tolerance.

27. Are there any opportunities for investing in green and renewable energy companies among Dow Jones stocks in 2024?

Yes, some Dow Jones companies are actively involved in green and renewable energy initiatives. Investors interested in green energy can research companies’ sustainability efforts and consider their exposure to renewable energy projects.

28. How can I evaluate the competitive positioning of technology companies like Intel in 2024?

Evaluating the competitive positioning of technology companies involves analyzing their market share, technological advancements, and partnerships. Additionally, assessing their ability to adapt to industry trends and emerging technologies is crucial.

29. What are the potential benefits of investing in home improvement companies like The Home Depot in 2024?

Investing in home improvement companies can benefit from increased consumer spending on home-related projects. The Home Depot’s market leadership and e-commerce initiatives can contribute to its growth potential.

30. How can I assess the financial stability of Dow Jones companies like Pfizer in 2024?

Assessing the financial stability of Dow Jones companies involves reviewing their financial reports, debt levels, cash reserves, and credit ratings. Analyzing these factors can provide insights into their financial health.

31. Is it advisable to invest in pharmaceutical companies like Pfizer in 2024, considering the ongoing healthcare landscape?

Investing in pharmaceutical companies like Pfizer can be advisable, given the ongoing need for healthcare solutions. Pfizer’s experience in vaccine development and diverse pharmaceutical portfolio make it an attractive choice for certain investors.

32. How can I stay informed about changes in consumer preferences when investing in companies like Nike in 2024?

Staying informed about changes in consumer preferences involves monitoring market research, consumer surveys, and industry trends. Companies like Nike often provide insights into consumer behavior through their reports and announcements.

33. What are the growth prospects for the telecommunications industry, and how can Verizon benefit in 2024?

The telecommunications industry’s growth prospects include the expansion of 5G technology, increased connectivity demands, and the proliferation of IoT (Internet of Things) devices. Verizon’s leadership in 5G positions it to benefit from these trends.

34. Can I invest in companies like Chevron with a focus on sustainable and renewable energy solutions in 2024?

Yes, investors interested in sustainable and renewable energy can research companies like Chevron for their commitment to environmentally responsible practices and investments in renewable energy projects.

35. How can I assess the potential impact of regulatory changes on energy companies like Chevron in 2024?

Assessing the impact of regulatory changes on energy companies involves monitoring government policies, environmental regulations, and energy industry trends. Regulatory shifts can influence energy companies’ operations and profitability.

36. Are technology companies like IBM actively involved in blockchain technology in 2024?

Yes, technology companies like IBM have been actively involved in blockchain technology, offering solutions for various industries. IBM’s expertise in blockchain positions it to cater to businesses seeking blockchain solutions.

37. Can I invest in healthcare companies like UnitedHealth Group for both growth and income in 2024?

Yes, healthcare companies like UnitedHealth Group often offer growth potential and consistent dividend payments, making them suitable for both growth and income-focused investors.

38. How can I assess the impact of healthcare policy changes on companies like UnitedHealth Group in 2024?

Assessing the impact of healthcare policy changes involves monitoring government healthcare policies, insurance regulations, and industry responses. Policy changes can influence healthcare companies’ operations and financial performance.

39. What is the role of artificial intelligence in technology companies like Cisco Systems in 2024?

Artificial intelligence plays a significant role in technology companies like Cisco Systems, enhancing networking capabilities, cybersecurity, and automation. Cisco’s focus on AI aligns with technological advancements in the industry.

40. Are there opportunities for sustainable investing in companies like Nike, considering their commitment to environmental responsibility in 2024?

Yes, investors interested in sustainable investing can research companies like Nike for their sustainability initiatives and environmentally friendly practices. Sustainable investing considers companies’ environmental and social responsibilities.

These frequently asked questions provide valuable insights into investing in Dow Jones stocks in 2024. As you navigate the world of investing, it’s essential to stay informed, conduct thorough research, and consider your investment goals and risk tolerance. Investing in stocks carries inherent risks, and seeking advice from financial professionals can help you make informed decisions.

Disclaimer

Investing in stocks involves risks, and it’s essential to conduct thorough research, consider your financial goals, and consult with a financial advisor before making investment decisions. The information provided in this article is for informational purposes only and should not be construed as investment advice. Past performance is not indicative of future results, and stock prices can fluctuate.

References

Books:

- Malkiel, Burton G. (2021). “A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing.” W. W. Norton & Company.

- Lynch, Peter, and Rothchild, John (2021). “One Up On Wall Street: How to Use What You Already Know to Make Money in the Market.” Simon & Schuster.

- Graham, Benjamin, and Zweig, Jason (2006). “The Intelligent Investor: The Definitive Book on Value Investing.” HarperBusiness.

- Bogle, John C. (2017). “The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns.” Wiley.

- Buffet, Warren E., and Lawrence A. Cunningham (2019). “The Essays of Warren Buffett: Lessons for Corporate America.” Carolina Academic Press.

Websites:

- Yahoo Finance: A comprehensive financial news and data platform offering stock quotes, news, investment resources, and tools for stock analysis.

- Investopedia: An educational website providing a wide range of investment and financial information, including articles, tutorials, and investment guides.

- Bloomberg: A global business and financial news network that offers real-time stock market updates, financial analysis, and investment insights.

- MarketWatch: A leading source for financial news, market data, and investment information, including stock quotes and analysis.

- Seeking Alpha: An online platform for crowdsourced investment research, offering articles, news, and analysis from a community of financial experts and contributors.

- CNBC: A popular financial news and television network providing coverage of stock markets, investing, and economic developments.

- The Motley Fool: A trusted source for stock market news, analysis, and investment advice, with a focus on long-term investing strategies.

- CNN Business: The business section of CNN, offering breaking news, market updates, and in-depth financial analysis.

- Morningstar: A leading independent investment research firm providing data, analysis, and ratings on stocks, mutual funds, and ETFs.

- SEC – U.S. Securities and Exchange Commission: The official website of the SEC, offering valuable resources for investors, including regulatory information and company filings.

These reference sources can assist readers in further exploring and researching the topics covered in this article. Whether you are a beginner or experienced investor, staying informed and conducting thorough research is essential for successful investing in Dow Jones stocks and the broader stock market.