Introduction : Meaning Of IPO

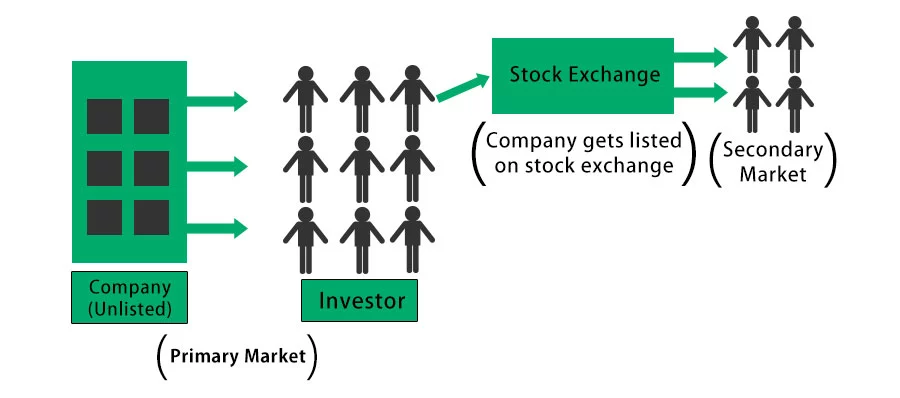

What is the meaning of IPO exactly? An initial public offering (IPO) is a company’s first offer of stock to the public. Prior to an IPO, a company is typically owned by its founders and private investors. An IPO allows a company to raise money by selling shares of its stock to the public.

An initial public offering, also known as an IPO, is the first time a company offers its shares to the public. The company sells a portion of its shares and uses the money it raises to grow its business.

An IPO is a very important event for a company. It can be a turning point in a company’s history. It can be when a small company becomes a big company. Or it can be when a young company becomes more mature.

There are many things that go into consideration, read everything about IPO in this detailed guide and become a stock market master by following InveShares.

What is Stocks IPO: Detailed Meaning of IPO

IPO: Initial Public Offering is a way of taking public your company, but with the stock only for a short time and it’s not very lucrative. But if you are equipped to get the right network than, you can get such opportunities. I am listing down the some reasons why you should consider to go for an IPO below. The initial public offering is the moment when an individual or company goes public in the stock market. It is when one sells their shares in their company to the general public. It’s an exciting moment for any entrepreneur to get their company into the market, where it will then be purchased by another company for pennies on the dollar.

A public offering of a company’s shares is a way companies can raise more money through an initial public offering of their shares. Companies, particularly tech-related companies, have been using this so-called “IPO” or “initial public offering” for years. In an earlier time, venture capitalist-backed tech combine”s used this type of financing to get more funding from potential investors. Ahead in this article, you will not only know the meaning of IPO but also, a complete guide toinvesting in an IPO.

Why Is An IPO Launched?

A IPO (initial public offering) is when a company sells shares on the stock market. They do this in order to raise funds for the company, and to help it grow and expand. The company that sells the shares on the stock market is known as the IPO company.y If you’re thinking about investing in some share, you’ll need some form of capital. The most common form of capital is stocks, and they can be bought and sold on the stock market.

You don’t need any technical or financial knowledge to invest in stocks. You just need Stocks are the shares that are sold in an IPO, or initial public offering. The shares are usually sold for either cash or in-kind consideration, depending on the company.

It IPO occurs when a company chooses to go public, by selling its shares to the public. Stocks can be either listed on a stock exchange or privately traded. Stocks IPO is the first step of the Initial Public Offering (IPO) process. This is when a company or startup decides to enter the public markets and sell stock to the public. An IPO is an Initial Public Offering of a company that raises money from investors. A company that’s looking to raise money through an IPO will usually have something to offer investors after they are done raising money through an IPO. Companies usually do not have funds to continue running during the IPO process, so they need to raise money quickly. An IPO can help a company raise money quickly and continue operating until they’re ready to restock their stocks.

The Benefits of an IPO

You will know all the advantages of an IPO below and as well as the exact meaning of IPO investments and its returns:

- The price of the stock is made available to investors before they purchase it; in other words, they can buy shares in advance.

- Investors who buy stock in an IPO are able to buy more shares than they would in a normal private sale. This means that when a share price rises, individual investors can make more money by selling their stake and buying more shares at a lower price.

- IPOs provide a reliable source of capital for ventures.

As an Entrepreneur You can look At these benefits of an IPO :

1. Access to Risk Capital:

Most companies will find it difficult to raise equity from venture capitalists and other big investors. It is not just about lack of availability of potential investors. There may be investors available but they may not be willing to give a fair valuation to the entrepreneurial venture. In such cases, it will be prudent to seek equity investment from the public who might be willing to value the company more generously.

2. Increased Public Image:

The public image of an enterprise also goes up once it has been publicly listed. It gets more recognition from suppliers and customers. Also, it becomes easier to attract companies. Moreover, banks will also be more willing to lend to listed companies than to closely held firms.

3. Stock Options

Labour laws in India permit issuing stock to employees even in the case of private limited companies. But, the laws make it very cumbersome and procedures are not very well designed to facilitate liquidity. In the case of public limited firms, it is very easy to set up employee stock option plans and motivate your employees.

What are the Risks of an IPO?

The IPOs can be very risky and some of the risks are listed down here:

- Shares may or may not be allotted in the IPO issuance. After you apply, if you are eligible or fall within the reserved quota set out for your investor category type, you will be allotted the shares, else not. So, there is no guarantee of you being issued shares as part of the IPO. Typically when there is over-subscription for an issue there are less chances of issuance of the shares.

- Valuation. Like for a stock, the right pricing at entry in the IPO is also crucial, and for this the valuation of the issue is highly crucial. As is the case now, there is a flurry of IPOs in the primary market when the liquidity is high and the indices are notching new highs and it is at this time that the offerings are made at high valuations.

- To make the complete analysis, there can be insufficient information available. For some of the first-timers in the industry, it shall be hard to determine how would the company perform.

- Regulatory issues also need to be factored. Say for instance in the last year concluded IPO offer of CAMS, these shares got listed on the NSE after 7 months of their entry into the capital market. This was because as at that time CAMS was being backed by NSE’s subsidiary firm.

- Volatility. These IPOs may see sharp volatility in the first few days of their trade and also there is no limit in respect of when the trades in such stocks can be frozen.

Points to remember when Investing In IPOs

Investing in IPO is not an easy task, so you should do proper research before investing in an IPO. Take into consideration these points before doing your IPO research:

- Like for stocks, leveraging should not be taken on to for investing in IPOs i.e. an individual or an HNI should not borrow funds to invest in IPO.

- Also, investors in IPO should not be unrealistic about their expectations of the IPO returns.

- Retail investors should not get into illegal trades i.e. in the grey market.

- When investing in IPOs it shall always be in the interest of investors to remain in the stock for a long run as with the company growth, your share in the company as shares will also see an growth.

- For IPO investment, one needs a good economy, company and industry. Understanding to fairly narrow down on the IPO which shall be good for them.

- Investors need not be lured by the newness of the company or industry instead should do adequate company and industry profiling together with its financial analysis as well as figure out the key risks as well as the areas that it may be exposed to across economic and business cycles.

- If the investor invested for making listing gains, but an IPO disappointed on that front, it may be wise to rather exit that investment early.

- Financials that need to be watched out include double digit return for Return on Equity as well as Return on capital employed. Also, earnings growth as well as its leverage position together with debt on the company’s balance sheet need to be definitely given a heed before investing in the offer. Positive cash flow should be another factor that needs to be kept in mind.

Conclusion : The Meaning of IPO

IPO Investment is one way to identify new investment opportunities as well as make some money by playing for listing gains. So it act both as trading and investment plan.

In recent times few great Companies have hit floor and investors have made money in those counters. IPO investment helps you get Companies at lesser price if you want to plan long term investment.

For example you will not get IRCTC or DMART or Adani Wilmar at IPO price post listing. This shows how beneficial it was for long term investment if they applied in the IPO.

Know about the best stock market strategy, the price action strategy here. Read other Insights on various Stock Market And Crypto Market Topics from InveShares here. Happy Investing, Happy Life!