Introduction : Stock Market Crash Of 1929

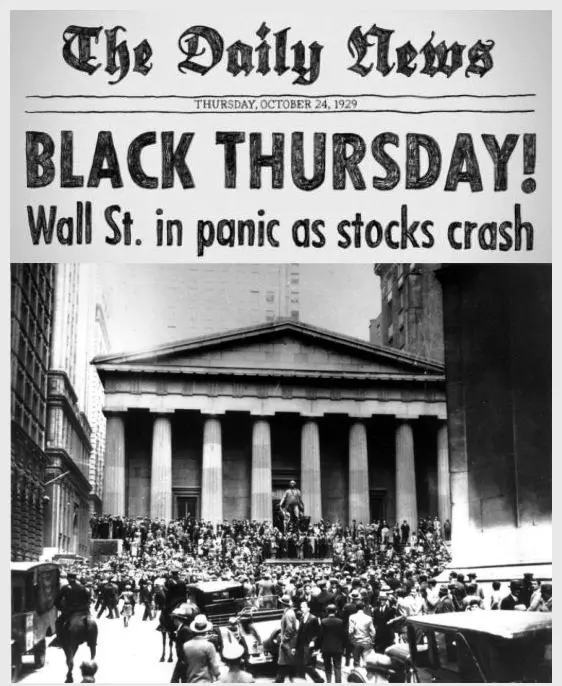

The Stock Market Crash of 1929, also known as Black Tuesday, was the most devastating event in US financial history. The stock market crash wiped out billions of dollars worth of paper assets and set off a chain reaction that led to one of the worst economic depressions in American history. The crash began on October 24, 1929 when the market reached an all-time high with more than three billion shares traded on that day alone.

By the end of this section, you will be able to:

- Identify the causes of the stock market crash of 1929

- Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly

- Explain how a stock market crash might contribute to a nationwide economic disaster

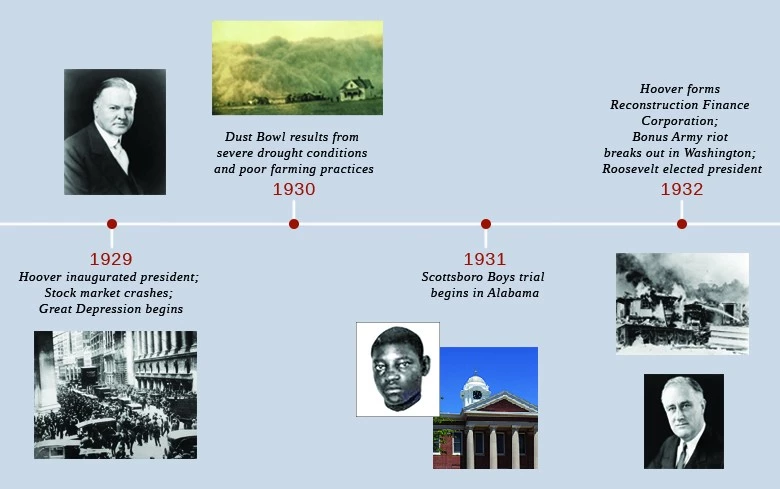

The decade, known as the “Roaring Twenties,” was a period of exuberant economic and social growth within the United States. However, the era came to a dramatic and abrupt end in October 1929 when the stock market crashed, paving the way into America’s Great Depression of the 1930s.

In the years to follow, economic upheaval ensued as the U.S. economy shrank by more than 36% from 1929 to 1933, as measured by Gross Domestic Product (GDP). Many U.S. banks failed, leading to a loss of savings for their customers, while the unemployment rate surged to over 25% as workers lost their jobs

Key Takeaways From Stock Market Crash Of 1929

- In October of 1929, the stock market crashed, wiping out billions of dollars of wealth and heralding the Great Depression.

- Known as Black Thursday, the crash was preceded by a period of phenomenal growth and speculative expansion.

- A glut of supply and dissipating demand helped lead to the economic downturn as producers could no longer readily sell their products.

Before the Crash: A Period of Phenomenal Growth

In the first half of the 1920s, companies experienced a great deal of success in exporting to Europe, which was rebuilding from World War I. Unemployment was low, and automobiles spread across the country, creating jobs and efficiencies for the economy. Until the peak in 1929, stock prices went up by nearly 10 times. In the 1920s, investing in the stock market became somewhat of a national pastime for those who could afford it and even those who could not—the latter borrowed from stockbrokers to finance their investments.

The economic growth created an environment in which speculating in stocks became almost a hobby, with the general population wanting a piece of the market. Many were buying stocks on margin—the practice of buying an asset where the buyer pays only a percentage of the asset’s value and borrows the rest from the bank or a broker—in ratios as high as 1:3, meaning they were putting down $1 of capital for every $3 of stock they purchased. This also meant that a loss of one-third of the value in the stock would wipe them out.

The Great Crash

The promise of the Hoover administration was cut short when the stock market lost almost one-half its value in the fall of 1929, plunging many Americans into financial ruin. However, as a singular event, the stock market crash itself did not cause the Great Depression that followed. In fact, only approximately 10 percent of American households held stock investments and speculated in the market; yet nearly a third would lose their lifelong savings and jobs in the ensuing depression. The connection between the crash and the subsequent decade of hardship was complex, involving underlying weaknesses in the economy that many policymakers had long ignored.

What Was the Crash?

To understand the crash, it is useful to address the decade that preceded it. The prosperous 1920s ushered in a feeling of euphoria among middle-class and wealthy Americans, and people began to speculate on wilder investments. The government was a willing partner in this endeavor: The Federal Reserve followed a brief postwar recession in 1920–1921 with a policy of setting interest rates artificially low, as well as easing the reserve requirements on the nation’s largest banks. As a result, the money supply in the U.S. increased by nearly 60 percent, which convinced even more Americans of the safety of investing in questionable schemes. They felt that prosperity was boundless and that extreme risks were likely tickets to wealth.

Named for Charles Ponzi, the original “Ponzi schemes” emerged early in the 1920s to encourage novice investors to divert funds to unfounded ventures, which in reality simply used new investors’ funds to pay off older investors as the schemes grew in size. Speculation, where investors purchased into high-risk schemes that they hoped would pay off quickly, became the norm. Several banks, including deposit institutions that originally avoided investment loans, began to offer easy credit, allowing people to invest, even when they lacked the money to do so. An example of this mindset was the Florida land boom of the 1920s: Real estate developers touted Florida as a tropical paradise and investors went all in, buying land they had never seen with money they didn’t have and selling it for even higher prices.

Causes of the Stock Market Crash Of 1929

- The crash of 1929 did not occur in a vacuum, nor did it cause the Great Depression. Rather, it was a tipping point where the underlying weaknesses in the economy, specifically in the nation’s banking system, came to the fore. It also represented both the end of an era characterized by blind faith in American exceptionalism and the beginning of one in which citizens began increasingly to question some long-held American values. A number of factors played a role in bringing the stock market to this point and contributed to the downward trend in the market, which continued well into the 1930s. In addition to the Federal Reserve’s questionable policies and misguided banking practices, three primary reasons for the collapse of the stock market were international economic woes, poor income distribution, and the psychology of public confidence.

- After World War I, both America’s allies and the defeated nations of Germany and Austria contended with disastrous economies. The Allies owed large amounts of money to U.S. banks, which had advanced them money during the war effort. Unable to repay these debts, the Allies looked to reparations from Germany and Austria to help. The economies of those countries, however, were struggling badly, and they could not pay their reparations, despite the loans that the U.S. provided to assist with their payments. The U.S. government refused to forgive these loans, and American banks were in the position of extending additional private loans to foreign governments, who used them to repay their debts to the U.S. government, essentially shifting their obligations to private banks.

- Poor income distribution among Americans compounded the problem. A strong stock market relies on today’s buyers becoming tomorrow’s sellers, and therefore it must always have an influx of new buyers. In the 1920s, this was not the case. Eighty percent of American families had virtually no savings, and only one-half to 1 percent of Americans controlled over a third of the wealth. This scenario meant that there were no new buyers coming into the marketplace, and nowhere for sellers to unload their stock as the speculation came to a close. In addition, the vast majority of Americans with limited savings lost their accounts as local banks closed, and likewise lost their jobs as investment in business and industry came to a screeching halt.

- Finally, one of the most important factors in the crash was the contagion effect of panic. For much of the 1920s, the public felt confident that prosperity would continue forever, and therefore, in a self-fulfilling cycle, the market continued to grow. But once the panic began, it spread quickly and with the same cyclical results; people were worried that the market was going down, they sold their stock, and the market continued to drop. This was partly due to Americans’ inability to weather market volatility, given the limited cash surpluses they had on hand, as well as their psychological concern that economic recovery might never happen.

In The Aftermath Of The Crash

After the crash, Hoover announced that the economy was “fundamentally sound.” On the last day of trading in 1929, the New York Stock Exchange held its annual wild and lavish party, complete with confetti, musicians, and illegal alcohol. The U.S. Department of Labor predicted that 1930 would be “a splendid employment year.” These sentiments were not as baseless as it may seem in hindsight. Historically, markets cycled up and down, and periods of growth were often followed by downturns that corrected themselves. But this time, there was no market correction; rather, the abrupt shock of the crash was followed by an even more devastating depression. Investors, along with the general public, withdrew their money from banks by the thousands, fearing the banks would go under. The more people pulled out their money in bank runs, the closer the banks came to insolvency..

The contagion effect of the crash grew quickly. With investors losing billions of dollars, they invested very little in new or expanded businesses. At this time, two industries had the greatest impact on the country’s economic future in terms of investment, potential growth, and employment: automotive and construction. After the crash, both were hit hard. In November 1929, fewer cars were built than in any other month since November 1919. Even before the crash, widespread saturation of the market meant that few Americans bought them, leading to a slowdown. Afterward, very few could afford them. By 1933, Stutz, Locomobile, Durant, Franklin, Deusenberg, and Pierce-Arrow automobiles, all luxury models, were largely unavailable; production had ground to a halt. They would not be made again until 1949. In construction, the drop-off was even more dramatic.

The damage to major industries led to, and reflected, limited purchasing by both consumers and businesses. Even those Americans who continued to make a modest income during the Great Depression lost the drive for conspicuous consumption that they exhibited in the 1920s. People with less money to buy goods could not help businesses grow; in turn, businesses with no market for their products could not hire workers or purchase raw materials. Employers began to lay off workers. The country’s gross national product declined by over 25 percent within a year, and wages and salaries declined by $4 billion. Unemployment tripled, from 1.5 million at the end of 1929 to 4.5 million by the end of 1930. By mid-1930, the slide into economic chaos had begun but was nowhere near complete.

Conclusion

Conclusion: With a lot of people having lost their fortunes during the Great Depression, it makes sense why some investors are hesitant to put their money in the stock market these days. However, there is still considerable potential for big gains in the market and trading can be very fun when done properly. Is investing in stocks something you’re interested in doing?

If you want to invest in the stock market, make sure that you do proper research before. Beware of your positions in the market, try not to fall in the traps of big traders and do safe investments in the stock market.

One of the most important things to remember when investing in stocks is to do proper research before you start trading. It’s never a good idea to make quick decisions, and that especially applies here. Be sure not to fall into any traps set by big traders or major stock market crash. Always be aware of your positions in the market and always try safe investments when trading stocks.

Read Stock Market Holidays : A Complete List here! Also, Read more awesome and informative articles here!