Introduction: History of Indian Stock Market

The history of Indian Stock Market is that its Asia’s oldest stock exchange and the world’s 10th largest stock exchange with a market capitalization of $2 trillion as of March. The BSE is the world’s largest exchange in terms of number of listed companies at 4,441 and is also the world’s fastest stock exchange with a median trade speed of 6 microseconds.

The BSE was established in 1875 by a group of eminent businessmen under the name “The Native Share and Stock Brokers Association”. The association was renamed as “The Bombay Stock Exchange” in 1913. In 1950, the BSE became the first stock exchange in the world to be recognized as an authorized exchange by the International Federation of Stock Exchanges.

Evolution of Indian stock market

The Indian stock market is one of the oldest and most developed in Asia. It has a history dating back to 1875, when the first stock exchange was established in Mumbai. The market has undergone a number of changes over the years, with the most significant occurring in the 1990s and 2000s.

The 1990s saw the introduction of new technology, which led to the development of a modern, electronic stock market. This allowed for the rapid trading of stocks and led to the growth of the market. In the 2000s, the market underwent further changes, with the introduction of new regulations and the development of new products. This led to increased investment in the market and a growth in the number of traded stocks. Today, the Indian stock market is one of the most developed and liquid markets in the world

Indian Stock Market Pre-Independence Era

The stock market in India is said to have existed since 1792. The Calcutta Stock Exchange, which is the oldest stock exchange in India, was established in 1875. The Bombay Stock Exchange (BSE) was established in 1885. The National Stock Exchange (NSE) was founded in 1992. The first stockbroker in India was Pherozeshah Mehta, who was also the first chairman of the Bombay Stock Exchange.

The stock market in India is regulated by the Securities and Exchange Board of India (SEBI). SEBI was established in 1988. It is responsible for regulating the stock market, the mutual fund industry, and the insurance industry in India.

Indian Stock Market Post-Independence Era

The Indian stock market has come a long way since its inception in 1875. The market has seen its share of booms and busts, but it has always bounced back. It is currently in a post-independence stage, and it is booming.

The market has seen a number of positive developments in the past few years. The introduction of the goods and services tax (GST) has helped to reduce the overall tax burden on businesses. The implementation of the demonetization policy has helped to curb the flow of black money into the market.

The government has also taken steps to improve the overall investment climate in the country. The launch of the Make in India campaign has helped to promote Indian businesses both domestically and internationally. The government has also taken steps to improve the ease of doing business in India.

The stock market has responded positively to these developments. The benchmark S&P BSE Sensex has rallied by over 30% in the past two years.

SEBI and Its Impact on the Stock Market

The Securities and Exchange Board of India (SEBI) is the regulator for the securities market in India. SEBI was established in the year 1988 and it regulates the securities market by issuing and enforcing the rules and regulations. SEBI also plays a very important role in the development and promotion of the securities market in India. The primary objective of SEBI is to protect the interest of the investors in the securities market.

The securities market in India has witnessed a lot of development in the last few years. The introduction of various reforms by SEBI has helped in the development of the securities market. The reforms introduced by SEBI include the following:

- The introduction of the Demat account which has helped in the easy and efficient transfer of securities.

- The starting of the online trading system which has helped in the easy and efficient execution of trades.

- The introduction of the margin trading system which has helped in the easy and efficient borrowing of funds for the purpose of trading in the stock market.

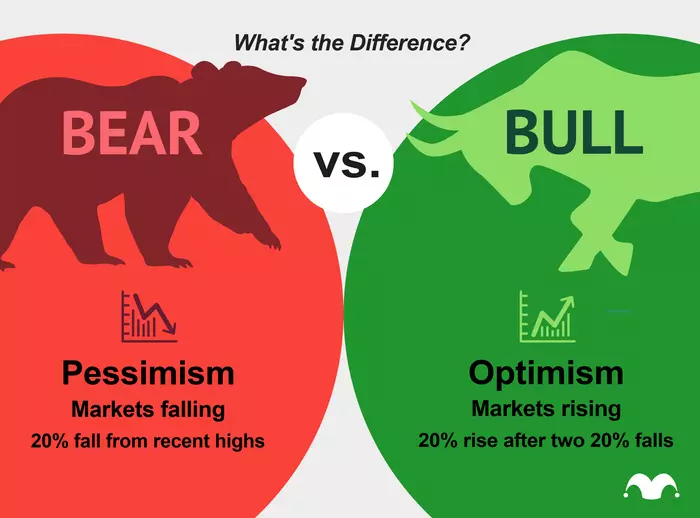

The bull and bear run in the Indian Stock Market

The Indian stock market has been on a bull run for the past few years. The Sensex and Nifty have both surged to new highs, with the Sensex crossing the 62,000 mark for the first time in its history. This bull run has been fuelled by a number of factors, including strong economic growth, falling interest rates, and improving corporate earnings.

However, there is a downside to this bull run. The valuations of Indian stocks have become quite high, and a correction could be in store. In addition, there are a number of risks that could derail the Indian economy, including a slowdown in global growth, a rise in interest rates, and a crisis in the banking sector.

So, is it time to sell Indian stocks and book profits? Or is this just a temporary setback and the bull run will resume soon? Only time will tell.

Stock derivatives in India

What are stock derivatives?

Derivatives are financial contracts whose value is based on the price of an underlying asset. The most common underlying assets are stocks, bonds, and commodities.

Derivatives can be used for a variety of purposes, including hedging risk, speculating on price movements, and arbitraging price differences.

How are stock derivatives traded in India?

Stock derivatives are traded on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).

The NSE offers derivatives contracts on 50 stocks, while the BSE offers derivatives contracts on 350 stocks.

What are the most popular stock derivatives in India?

The most popular stock derivatives in India are:

- Futures contracts

- Options contracts

- Index futures contracts

- Index options contracts

- Single stock futures contracts

- Single stock options contracts

Conclusion : History Of Indian Stock Market

The Indian stock market is one of the most rapidly growing economies in the world and If you’re looking to invest your money and see it grow, the stock market is the best way to do it. With a little bit of research and a lot of patience, you can make a lot of money in the Indian stock market.

It is one of the most promising in the world. With a growing economy, there is no better time to invest in Indian stocks. Our experts can help you get started today! Click here to learn more about the benefits of investing in the Indian stock market.

Want to know more about the great stock market crash of 1929, check it out here. Read more awesome articles related to the stock market here.