Introduction: Investing in the Stock Market

Are you considering investing in the stock market but need help knowing where to start? Don’t worry; you’re not alone. The stock market can seem overwhelming and confusing, especially for beginners. But with the proper guidance and knowledge, anyone can become a successful investor. This blog post will cover everything you desire to know to get started on your investing journey to financial independence through stock market investing. Let’s understand value investing in this article.

What is the Stock Market?

The stock market is a marketplace where publicly traded companies’ stocks (or shares) are bought and sold. A company’s stock represents ownership in that company, and the price of a stock reflects the market’s evaluation of the company’s prospects. When you invest in the stock market, you’re buying a small amount of ownership in a Public company and betting that the company will be successful, which will drive up the value of your investment.

Why Invest in the Stock Market?

There are a many reasons why people choose to invest in the stock market. Some of the most common causes include:

- Diversification: By investing in various stocks, you can spread your risk and reduce the impact of any single stock’s poor performance on your overall portfolio.

- Inflation protection: Historically, the stock market has been able to keep pace with inflation, which means that your investments can maintain their purchasing power over time.

Of course, investing in the stock market is not without risk. The amount of your investments can go down and up, and there’s no guarantee that you’ll make a profit. However, by educating yourself and making informed investment decisions, you can minimize your risk and increase your chances of success.

How to Get Started in Stock Market Investing

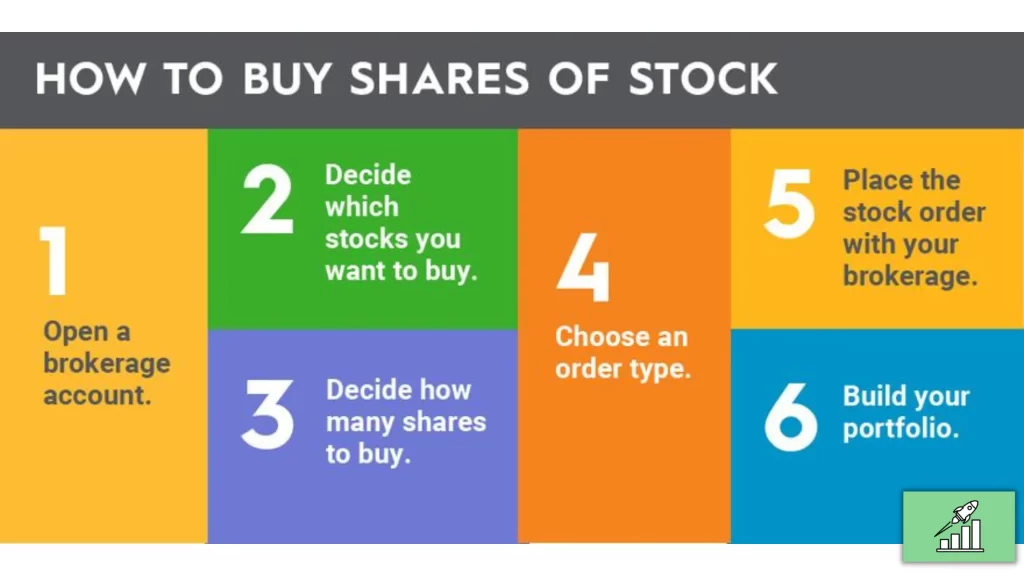

Getting started in stock market investing can seem daunting, but it’s pretty simple. Here are the steps you should follow:

- Educate yourself: Before you start investing, learning as much as possible about the stock market and how it works is essential. This will help you make informed investment decisions and avoid costly mistakes. You can find the majority of information online or by reading books and other resources about investing.

- Determine your investment goals: Before you start with investing journey, it’s essential to determine what you’re hoping to achieve through your investments. This includes retirement savings, paying for education, or building wealth for the future. A clear understanding of your investment goals will help you make informed investment decisions and stay focused on your long-term goals.

- Open a brokerage account: To start investing in the stock market, you’ll need to open a brokerage account. This is an account that allows you to buy and sell stocks. Many online brokers offer brokerage accounts, and you can compare their fees, services, and investment options to find the one that’s right for you.

- Start small: When you’re first starting out, it’s a good idea to start with a small amount of money and invest in a few high-quality stocks. As you become more confident in your investment strategies, you can gradually increase your investment portfolio.

- Diversify your investments: To minimize your risk, it’s essential to diversify your investments. This means investing in a variety of stocks from different industries, as well as other types of investments.

Investing in Sustainable Stocks

Investing in the stock market can be an awesome way to build wealth over time, but it’s crucial to approach it with a well-informed strategy. One key aspect of investing in the stock market is choosing the right stocks to invest in; this is where keyword research comes in.

By researching keywords related to the stock market, you can better understand the types of stocks in demand and make more informed investment decisions. In this blog post, we’ll focus on a keyword that has less competition and is related to the stock market: “sustainable stocks”.

Sustainable stocks prioritize environmental, social, and governance (ESG) factors in their business practices. These companies are seen as more responsible and ethical, and as such, they are increasingly in demand among investors. Furthermore, studies have shown that companies with strong ESG practices tend to perform better financially over the long term.

Why Invest in Sustainable Stocks?

There are several reasons why investing in sustainable stocks can be a smart choice for investors. Here are just a few:

- Long-term financial performance: Companies that prioritize ESG factors are often better managed and have a more stable business model, which can lead to better financial performance over the long term.

- Growing demand: As consumers become more environmentally and socially conscious, they are increasingly choosing to do business with companies that prioritize ESG factors. Companies that prioritize ESG are likely to see growing demand for their products and services, which can lead to higher profits and more robust financial performance.

- Risk mitigation: Companies that prioritize ESG factors are less likely to be exposed to environmental, social, and governance risks, which can negatively impact their financial performance. By investing in sustainable stocks, you can reduce the risk of your portfolio being negatively affected by such risks.

- Diversification: Investing in sustainable stocks can help diversify your portfolio, as sustainable stocks often perform differently from traditional stocks. This can help reduce your overall portfolio risk.

How to Invest in Sustainable Stocks

There are several ways to invest in sustainable stocks, including:

- Direct investment: You can buy individual sustainable stocks and hold them in your portfolio. This gives you complete control over your investments, but it also requires significant research and monitoring to succeed.

- ETFs and mutual funds: Exchange-traded funds (ETFs) and mutual funds that focus on sustainable stocks are other options for investors. These funds expose you to various sustainable stocks, and professionals manage them with expertise in this area.

- SRI funds: Socially responsible investment (SRI) funds are another option for investors who want to invest in sustainable stocks. SRI funds are similar to ETFs and mutual funds, but they focus on companies prioritizing ESG factors.

Regardless of your chosen method, it’s essential to research and understands the risks involved with each type of investment. It would be best if you also considered working with a financial advisor who can help you make informed investment decisions.

FAQs

Q: What are sustainable stocks?

A: Sustainable stocks prioritize environmental, social, and governance (ESG) factors in their business practices.

Q: Why invest in sustainable stocks?

A: Investing in sustainable stocks can provide long-term financial performance, growing demand, risk mitigation, and diversification.

Q: How can I invest in sustainable stocks?

A: You can invest in sustainable stocks through direct investment, ETFs and mutual funds,

Q: What are the risks involved in stock market investing?

A: The stock market is inherently risky, and investing in it involves losing some or all of your invested capital. The risks involved in stock market investing include the following:

- Market risk: The risk of losing money due to fluctuations in the overall stock market.

- Company-specific risk: The risk of investing in a company that performs poorly can result in a loss of your investment.

- Interest rate risk: The risk that interest rate changes will negatively impact your investments’ value.

- Liquidity risk: Unable to sell your stocks when you need to because there are no buyers.

- Understanding these risks and being comfortable with them before investing in the stock market is essential.

Q: What is the difference between buying stocks and investing in a mutual fund?

A: Stocks represent ownership in a single company, while mutual funds are portfolios of many different stocks or bonds managed by professional fund managers. A mutual fund allows you to diversify your portfolio and spread your risk across several investments. Buying individual stocks involves taking on a higher level of risk as you are betting on the success of a single company.

Q: How much money do I need to start investing in the stock market?

A: There is no minimum amount required to start investing in the stock market, but many financial experts suggest starting with a small amount, such as a few hundred dollars, and gradually increasing your investments as you become more comfortable with the process.

Q: What is the best way to start investing in the stock market?

A: There is no single “best” way to start investing in the stock market, as the right approach will vary depending on your circumstances, financial goals, and risk tolerance. However, a good starting point for many people is to work with a financial advisor to develop an investment strategy tailored to their needs and goals.

Q: How do I research stocks to determine which ones to invest in?

A: There are many factors to consider when researching stocks to determine which ones to invest in, including the company’s financial health, its competitive position in the market, and the outlook for its industry. Additionally, it’s essential to review the company’s earnings and revenue growth, as well as its dividend yield and other financial metrics. You can also review analyst reports and stock market news to stay up-to-date on the latest developments in the stock market.

Conclusion

In conclusion, stock market investing is a valuable way to grow your wealth over time. Understanding the basics of stock market investing, including the types of stocks, stock market indexes, and the role of a stockbroker is the first step towards becoming a successful investor.

Investing in stocks does come with risks, but with proper research and education, these risks can be managed and minimized. As with any investment, it is crucial to have a well-diversified portfolio and to review and adjust your investments regularly as necessary.

If you’re ready to start investing in the stock market, consider visiting inveshares.com. Our platform provides the tools and resources you need to make informed investment decisions and reach your financial goals. Whether you’re a seasoned investor or just starting out, Inveshares.com is a great place to begin your stock market journey.

In conclusion, stock market investing is a valuable way to grow your wealth over time. Understanding the basics of stock market investing, including the types of stocks, stock market indexes, and the role of a stockbroker is the first step towards becoming a successful investor.

Investing in stocks does come with risks, but with proper research and education, these risks can be managed and minimized. As with any investment, it is crucial to have a well-diversified portfolio and to review and adjust your investments regularly as necessary.

If you’re ready to invest in the stock market, consider visiting Inveshares.com. Our platform provides the tools and resources you need to make informed investment decisions and reach your financial goals. Whether a seasoned investor or starting, Inveshares.com is a great place to begin your stock market journey.