Introduction : When does the Stock Market Crash?

The stock market is notoriously difficult to predict. Many factors – from the political to the economic – can affect stock prices. So, when does the stock market crash? Unfortunately, there’s no easy answer. However, there are some indicators that investors can watch to get a sense of when a crash might be on the horizon. In this blog post, we’ll explore five of these indicators.

The stock market is a complex and ever-changing beast. While there are no guaranteed indicators of when a crash will happen, there are certain red flags that investors can watch out for. In this blog post, we’ll explore five of these indicators.

What Is A Stock Market Crash?

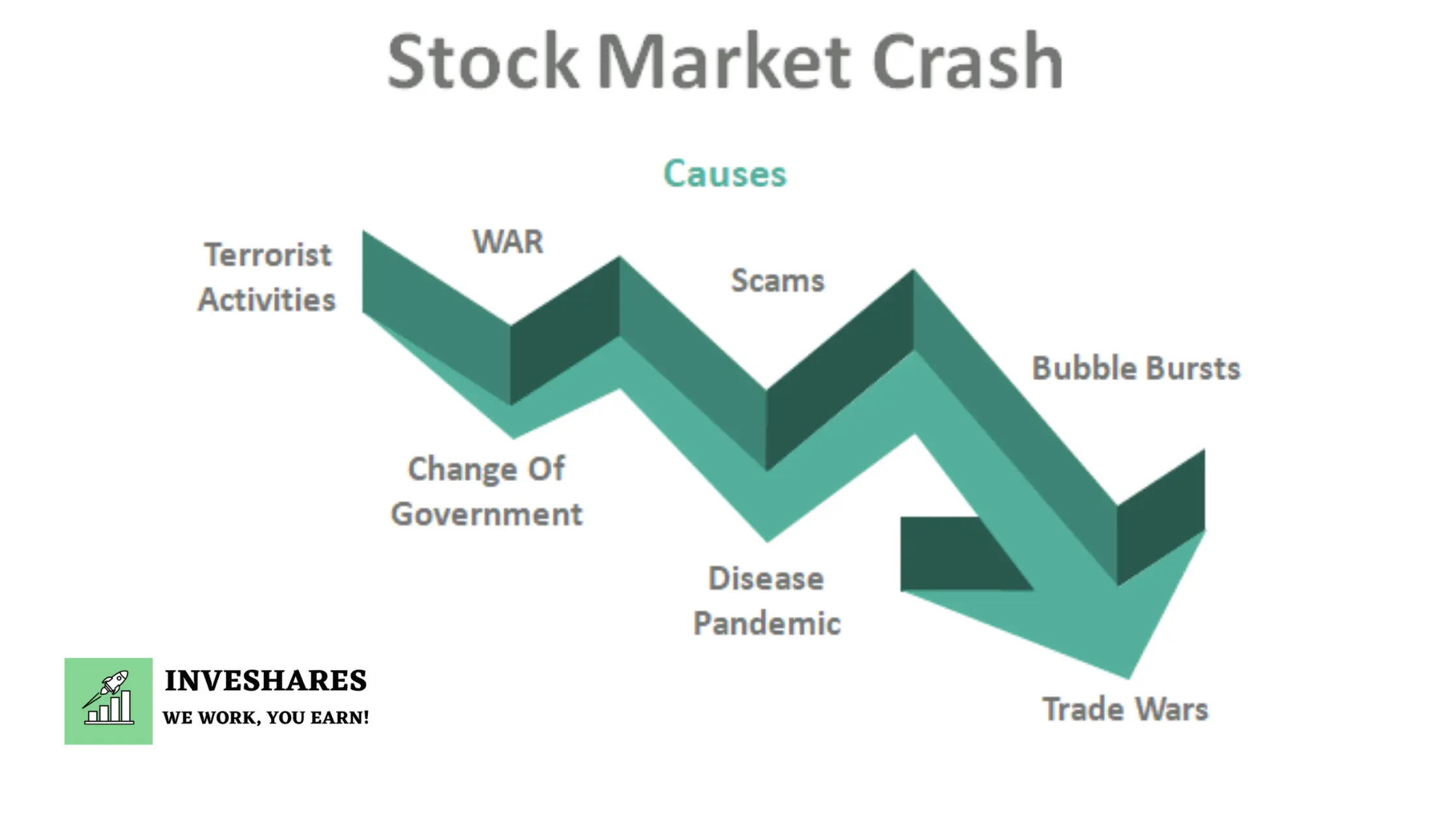

A stock market crash is a surprising dramatic decline of inventory costs across a major cross-section of a stock marketplace, ensuing in a large lack of paper wealth. Crashes are pushed with the aid of panic selling and underlying monetary elements. They frequently comply with hypothesis and financial bubbles.

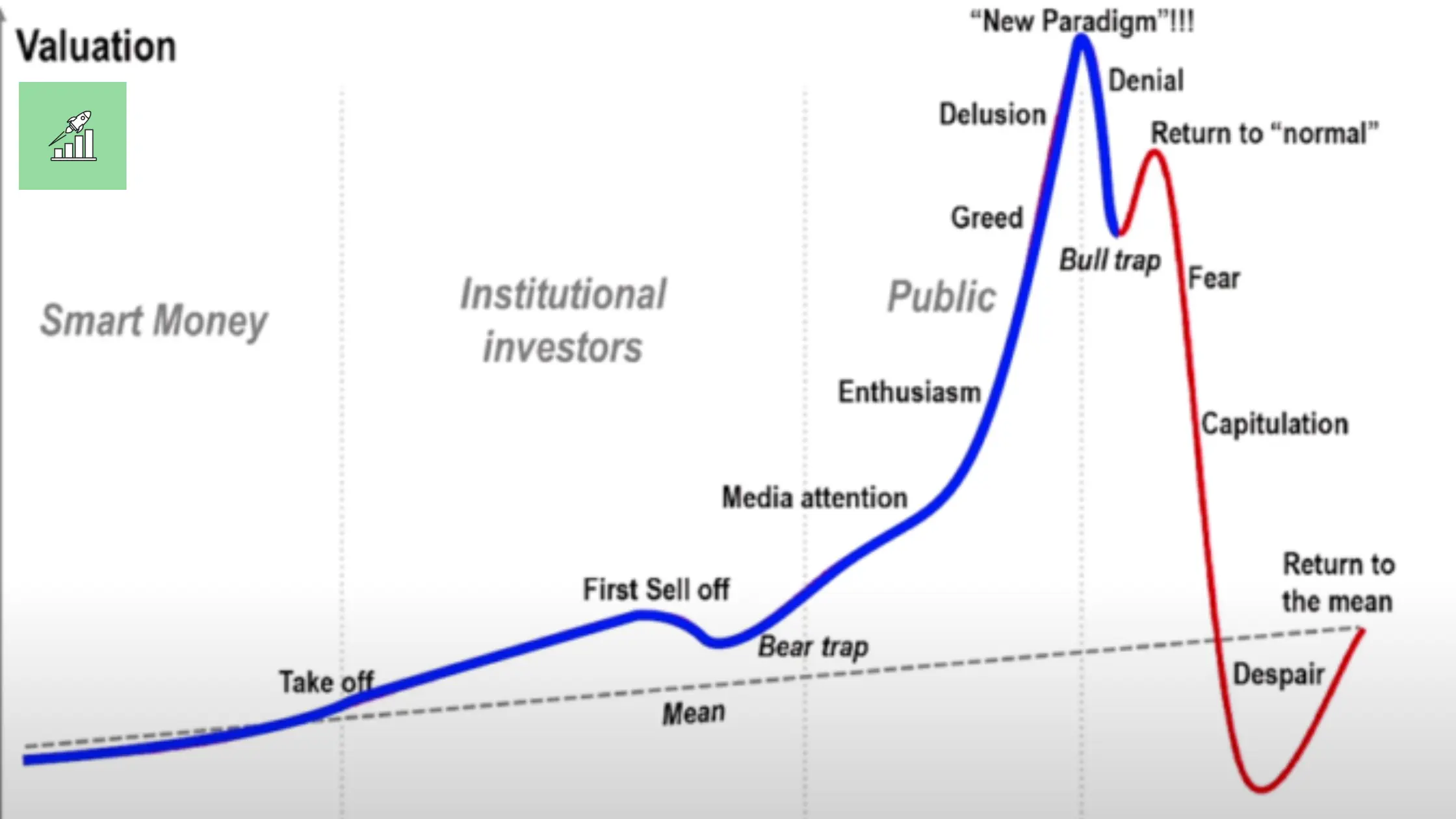

A stock market crash is a social phenomenon in which external monetary activities combine with crowd psychology in a superb feedback loop wherein selling with the aid of a few market members drives more market contributors to sell. generally speaking, crashes usually occur under the following conditions: a extended length of rising stock prices (a bull market) and excessive economic optimism, a market where price–earnings ratios exceed long-time period averages, and giant use of margin debt and leverage by way of market individuals. other aspects which includes wars, massive corporate hacks, modifications in federal laws and rules, and natural disasters inside economically efficient areas may affect a large decline within the stock market cost of a wide range of shares. stock prices for corporations competing against the affected corporations may rise despite the crash.

There is no numerically particular definition of a stock market crash but the term normally applies to declines of over 10% in a stock market index over a duration of numerous days. Crashes are regularly distinguished from bear markets (intervals of declining stock market charges that are measured in months or years) as crashes consist of panic selling and abrupt, dramatic price declines. Crashes are frequently associated with bear markets; but, they do not always arise concurrently. Black Monday (1987), as an example, did not result in a bear market. Likewise, the bursting of the Japanese asset price bubble occurred over several years without any notable crashes. stock market crashes are not common.

Five Indicators To Watch

Generally Speaking, No one can predict a stock market crash with a 100% certainty but surely there are some indicators and some events which can give us a hint about a stock market crash. These crashes in the stock market are very rare but really deadly for a lot of penny/retail investors because of the mistakes they do in a bear market, that is, when the stock market crashes. Here is the list of the five most important indicators to predict about a stock market crash

1.The Yield Curve

The yield curve is one of the most important indicators for the stock market. It is a measure of the difference between short-term and long-term interest rates. When the yield curve is flat or inverted, it is a sign that the stock market is about to crash.

An inverted yield curve happens when short-term rates are higher than long-term rates. This is a sign that the market is about to crash because it indicates that investors are more worried about short-term risks than long-term risks.

A flat yield curve happens when short-term rates are close to long-term rates. This is not necessarily a sign that the market is about to crash, but it does indicate that investors are worried about the future.

If you are worried about the stock market crashing, you should keep an eye on the yield curve. If it starts to flatten or invert, it is a sign that the market is about to crash.

2.The Dollar

When it comes to a stock market crash, the relevance of the dollar is often debated. Some say that a strong dollar is a sign that the market is about to crash, while others claim that a weak dollar is to blame. So, what is the truth?

The dollar’s relevance to a stock market crash is actually quite simple. If the market is crashing and the dollar is strong, then it means that investors are selling off their stocks and buying up safe-haven assets like gold and silver. This flight to safety causes the value of the dollar to rise.

On the other hand, if the market is crashing and the dollar is weak, then it means that investors are dumping their dollars in favor of other currencies. This flight from the dollar causes its value to plummet.

So, in a nutshell, the strength or weakness of the dollar is a good indicator of how investors are feeling about the stock market. If they’re feeling confident, they’ll keep their money in stocks;

3.Gold

When it comes to a stock market crash, gold is often seen as a safe haven for investors. This is because gold is seen as a store of value, and one that is not subject to the same volatility as stocks. While there is no guarantee that gold prices will go up in the event of a stock market crash, it is often seen as a safe investment that can provide stability in times of economic turmoil.

Gold is often seen as a safe investment option in times of financial turmoil. However, this is not always the case. In a stock market crash, gold may not be as safe an option as people think.

Gold is not a dependable store of value in a stock market crash. In a stock market crash, the value of stocks can plummet, and gold may not be as valuable as it was before the crash. This means that people who invested in gold during a stock market crash may not be able to get their hands on enough gold to cover their losses.

Gold is also not a reliable investment during times of political uncertainty. Political uncertainty can lead to a stock market crash, which can damage the value of gold.

Therefore, gold should not be seen as a guaranteed safe investment in times of financial turmoil. It is important to do your research and decide what is the best investment for you in any given situation.

4.Sentiment

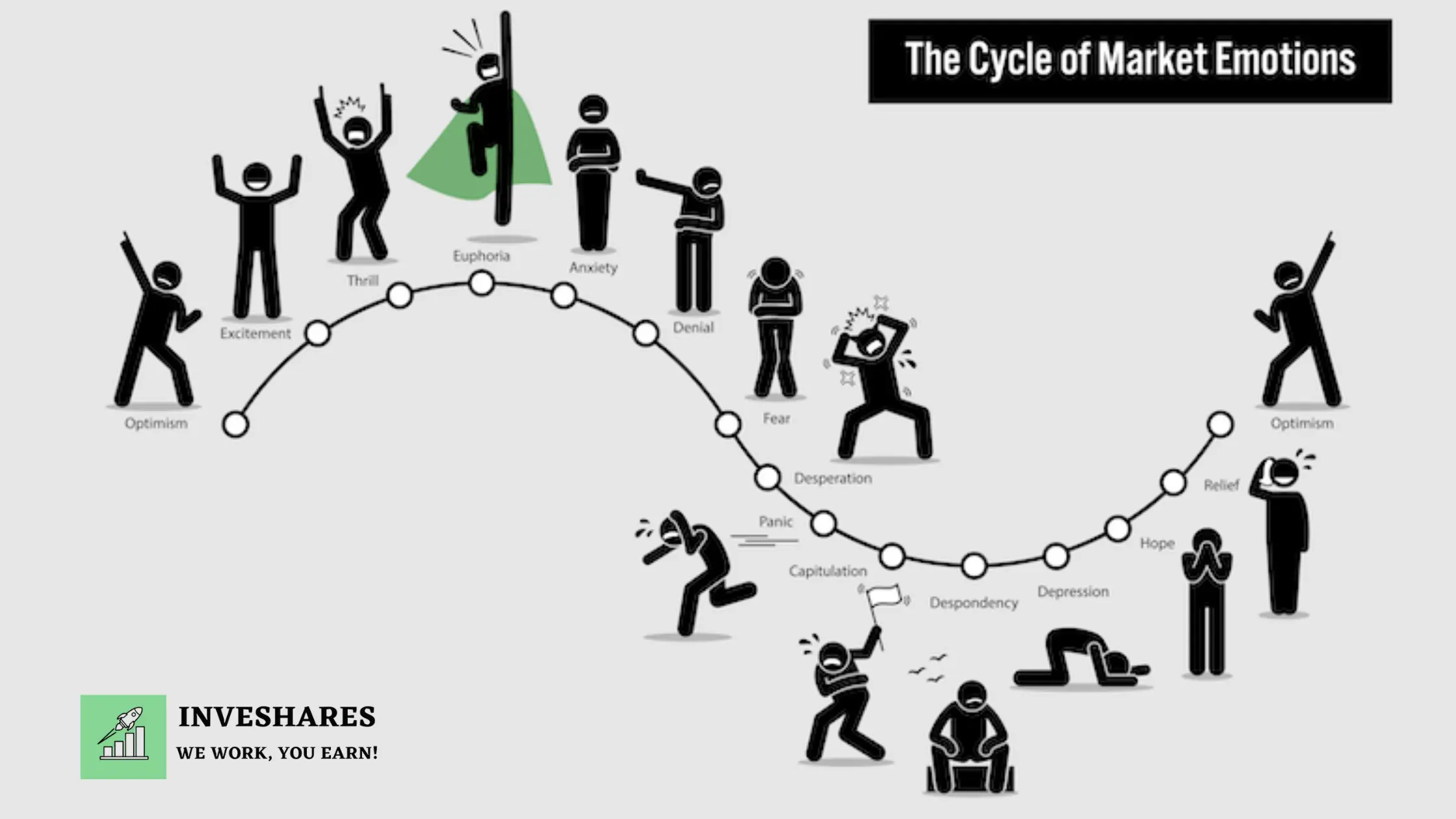

When it comes to the stock market, sentiment can be a tricky thing. On the one hand, it can be a powerful force that can propel the market to new heights. On the other hand, it can be a destructive force that can lead to a crash.

So, what is sentiment? Simply put, it is the mood or attitude of investors. It can be bullish (optimistic) or bearish (pessimistic). And, it can change very quickly.

When sentiment is bullish, investors are buying stocks because they believe the market will go up. This can create a self-fulfilling prophecy, as more buying leads to higher prices.

Conversely, when sentiment is bearish, investors are selling stocks because they believe the market will go down. This can also create a self-fulfilling prophecy, as more selling leads to lower prices.

Sentiment can be a very powerful force in the stock market. It can drive prices up or down

5.Technical Indicators

When it comes to technical indicators, there are many different ways to measure a stock market crash. But, one of the most common technical indicators is the VIX. The VIX is a measure of market volatility and is often used as a predictor of stock market crashes.

When the VIX is high, it means that there is a lot of uncertainty in the market and that investors are nervous. This often leads to a sell-off in the stock market.

Another technical indicator that is sometimes used to predict stock market crashes is the put/call ratio. This is a measure of the number of put options (options that allow you to sell a stock at a certain price) that are traded versus the number of call options (options that allow you to buy a stock at a certain price).

When the put/call ratio is high, it means that there are more people selling than buying and that the market is getting nervous. This often leads to a stock market crash

What to do when the Indicators show a Crash is Coming?

When stock indicators show a crash is coming, there are a few things investors can do to protect themselves. One option is to sell stocks and move to cash. This way, you won’t lose money if the stock market crashes. Another option is to buy stocks that are less likely to be affected by a crash. For example, stocks in companies that make products that people need, such as food or medicine, tend to do better in a downturn. You can also invest in bonds, which tend to go up in value when stock prices fall.

Of course, no one can predict the future, so it’s important to remember that a crash may not happen. If you sell your stocks and the market doesn’t crash, you’ll miss out on any gains that occur. And if you buy stocks that do well in a downturn, you may not make as much money if the market doesn’t crash. So, it’s important to

Conclusion : When does the Stock Market Crash?

The stock market crashes when investors become fearful of the future and sell their stocks. In conclusion, there are a number of indicators to watch for a stock market crash. These include high valuations, increasing debt levels, negative economic news, and technical indicators. While no one can predict the exact timing of a market crash, being aware of these indicators can help you be prepared and take steps to protect your portfolio.

Thus, be safe from all the lucrative market overvaluations and false practices and invest your hard earned money safely. It’s better to have an safe Investment than be sorry for your investments. Do read other helpful articles from InveShares here. Follow InveShares for more such awesome content!