Introduction

The stock market is a dynamic and ever-evolving industry that offers a variety of job opportunities for individuals with a passion for finance and a desire to make a difference in the world of business. From stockbrokers and financial analysts to portfolio managers and traders, the stock market offers a range of roles that require unique skills and qualifications. It is important for individuals to be informed about the different types of stock market jobs available, as well as the skills and qualifications required for each role.

This article aims to provide a comprehensive overview of stock market jobs, covering everything from the different career paths available to the salary expectations and requirements for each role. By understanding the different opportunities available in the stock market, individuals can make informed decisions about their career paths and set themselves on the path to success. Whether you are just starting out in your career or looking to make a change, this article is a valuable resource for anyone interested in pursuing a career in the stock market.

What is a Stock Market Job?

A stock market job refers to any role that involves buying and selling securities in the stock market. The stock market is a complex and dynamic industry that offers a wide range of job opportunities for individuals with a passion for finance and a desire to make a difference in the world of business. There are many different types of jobs in the stock market, including stockbrokers, financial analysts, portfolio managers, traders, and more.

The responsibilities and duties of each stock market job vary greatly. Stockbrokers, for example, are responsible for executing trades on behalf of their clients and providing advice on investment strategies. Financial analysts, on the other hand, are responsible for researching and analysing stocks and making recommendations to clients and portfolio managers. Portfolio managers, in turn, are responsible for overseeing the investment portfolios of clients and making investment decisions. Traders, meanwhile, buy and sell securities in the stock market, seeking to make a profit for their clients or themselves.

Regardless of the specific role, all stock market jobs require a strong understanding of the stock market and finance, as well as the ability to make informed decisions and effectively manage risk. With the right combination of education, experience, and skill, individuals can build successful careers in the stock market and make a real impact in the world of finance.

Best Career in the Stock Market

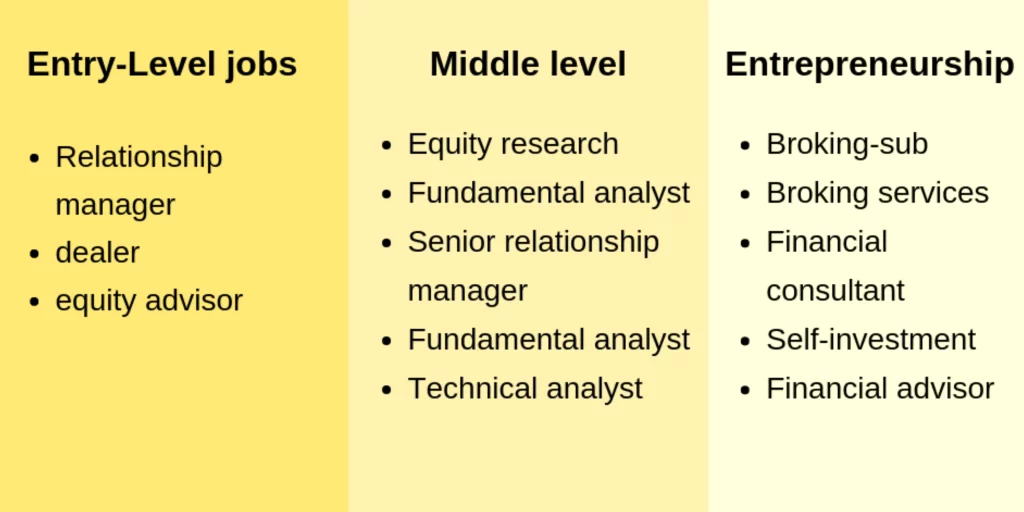

When it comes to choosing a career in the stock market, there are several options available. Each career has its own set of pros and cons, and the best career for one individual may not be the best for another. To determine the best career in the stock market, it is important to consider your individual strengths and interests.

Some of the most popular careers in the stock market include stockbrokers, financial analysts, portfolio managers, traders, and investment bankers. Stockbrokers are responsible for executing trades on behalf of their clients and providing investment advice. Financial analysts research and analyze stocks, making recommendations to clients and portfolio managers. Portfolio managers oversee the investment portfolios of clients, making investment decisions on their behalf. Traders buy and sell securities in the stock market, seeking to make a profit for their clients or themselves. Investment bankers, meanwhile, help companies raise capital by issuing and selling securities.

Each career in the stock market has its own unique set of pros and cons. Stockbrokers, for example, often have the opportunity to work with a wide range of clients and earn high commissions. Financial analysts, on the other hand, may enjoy the intellectual challenge of researching and analyzing stocks. Portfolio managers, meanwhile, may enjoy the satisfaction of helping clients grow their wealth.

Ultimately, the best career in the stock market will depend on your individual strengths and interests. If you have strong communication and interpersonal skills, for example, a career as a stockbroker may be a good fit. If you enjoy research and analysis, a career as a financial analyst may be a good fit. Whatever your strengths and interests, there is a career in the stock market that is right for you.

How to Get a Job in the Stock Market?

Getting a job in the stock market can be a challenging and competitive process, but with the right preparation and strategy, it is possible to break into this exciting and rewarding industry.

The first step in getting a job in the stock market is to familiarize yourself with the different career options available, and the eligibility criteria for each job. For example, many jobs in the stock market, such as stockbrokers and traders, require a bachelor’s degree in finance, economics, or a related field. Other careers, such as portfolio managers and investment bankers, may require a master’s degree in business administration (MBA) or a relevant field.

To increase your chances of getting hired, it is important to prepare thoroughly for job interviews. This may involve researching the company and the specific job, practicing your answers to common interview questions, and dressing professionally for the interview. Networking can also be an effective way to increase your chances of getting hired in the stock market.

The stock market is a rapidly growing industry, with a wide range of job opportunities available. Whether you are looking to work as a stockbroker, financial analyst, portfolio manager, trader, or investment banker, there is a job in the stock market that is right for you. With the right preparation and strategy, you can break into this exciting and rewarding industry and start your career in the stock market.

Stock Market Professional Salary

A. Explanation of the average salary of a stock market professional

- The average salary of a stock market professional can vary greatly based on factors such as location, experience, and job role.

- According to Glassdoor, the average salary for a stock market professional in the United States is approximately $80,000 per year.

B. Comparison of salaries of different jobs in the stock market

- Stockbroker: $57,000 – $145,000 per year

- Financial analyst: $60,000 – $120,000 per year

- Portfolio manager: $90,000 – $200,000 per year

- Trader: $75,000 – $200,000 per year

- Investment banker: $85,000 – $250,000 per year

C. Factors affecting salary in the stock market

- Location: Salaries can vary greatly based on the location of the job. For example, salaries in major cities such as New York, London, and Hong Kong tend to be higher than in smaller cities.

- Experience: Experience plays a significant role in determining salary in the stock market. As a stock market professional gains more experience, their salary is likely to increase.

- Job role: Different job roles in the stock market have different salary ranges. For example, traders tend to have higher salaries than stockbrokers, and investment bankers tend to have higher salaries than financial analysts.

Table: Average Salary of Stock Market Jobs

| Job Role | Average Salary |

| Stockbroker | $57,000 – $145,000 |

| Financial analyst | $60,000 – $120,000 |

| Portfolio manager | $90,000 – $200,000 |

| Trader | $75,000 – $200,000 |

| Investment banker | $85,000 – $250,000 |

NSE Jobs and Eligibility

A. Explanation of NSE jobs

- NSE (National Stock Exchange) is one of the leading stock exchanges in India.

- NSE offers various job opportunities for those who are interested in the stock market.

- Jobs available at NSE include positions like market analysts, traders, and sales executives.

B. Overview of the eligibility criteria for NSE jobs

- The eligibility criteria for NSE jobs vary depending on the position being applied for.

- However, a basic qualification in finance, economics, or commerce is usually required.

- A Master’s degree in finance or business administration may be preferred for certain positions.

C. Tips for preparing for NSE exams

- Prepare well for the entrance exams conducted by NSE.

- Brush up on basic finance, economics, and accounting concepts.

- Stay updated with current market trends and news.

- Practice with mock tests to increase speed and accuracy.

D. Explanation of how to join NSE

- Apply for NSE jobs through their official website or through job portals.

- Participate in the entrance exams conducted by NSE.

- Go through several rounds of interviews to finalize the selection.

E. Overview of job opportunities in NSE

- NSE offers various job opportunities for those who are interested in the stock market.

- Jobs available at NSE include market analysts, traders, and sales executives.

- The salary offered by NSE varies based on the position and qualifications of the individual.

Qualification for Stock Market and Stock Broker Jobs

The stock market and stock broker jobs require a certain level of education and training to be eligible for these roles. While the minimum educational requirements may vary based on the specific job, having a bachelor’s degree in finance, economics, or a related field is often preferred. Additionally, professional courses and certifications can help to enhance one’s skills and increase their chances of landing a job in the stock market.

Minimum Educational Requirements:

- Bachelor’s degree in finance, economics, or a related field

Professional Courses and Certifications:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Series 7 and Series 63 exams

Table: Professional Courses and Certifications in the Stock Market

| Course/Certification | Description |

| Certified Financial Planner (CFP) | A certification for financial planners that covers the financial planning process, tax planning, investment planning, retirement planning, and estate planning. |

| Chartered Financial Analyst (CFA) | A globally recognized professional designation for investment professionals that covers investment analysis and portfolio management. |

| Series 7 and Series 63 exams | Exams required for individuals seeking to become registered representatives of a broker-dealer and work as stockbrokers. |

In addition to the minimum educational requirements and professional courses and certifications, it is also important to continually update one’s knowledge and skills in the stock market. Staying current with industry developments and advancements can help to increase job opportunities and success in the stock market.

Starting a Stock Trading Career

A. Steps Involved in Starting a Stock Trading Career

- Starting a career in stock trading can be a rewarding and challenging journey, here are the steps involved:

- Get educated about the stock market: Gain a thorough understanding of how the stock market works and the various financial instruments available.

- Open a brokerage account: Choose a reputable broker and open a brokerage account to start trading stocks.

- Develop a solid understanding of trading: Study trading strategies and techniques and keep up-to-date with market news and trends.

- Create a trading plan: Define your goals, risk tolerance, and trading strategies, and stick to your plan.

- Start small and manage your risk: Start with small trades and limit your risk by diversifying your portfolio and setting stop-loss orders.

- Continuously monitor and evaluate your performance: Regularly evaluate your trades, adjust your strategy as needed, and strive to continuously improve.

B. Skills and Knowledge Required for a Successful Stock Trading Career

- To be successful in stock trading, you’ll need to develop certain skills and knowledge, including:

- Financial market knowledge: Understanding of how stock markets work and the various financial instruments available for trading.

- Analytical skills: Ability to analyze financial data and make informed trading decisions.

- Risk management: Understanding of how to manage risk and protect your capital.

- Trading psychology: Ability to control emotions and stay disciplined while trading.

- Technical analysis: Understanding of chart patterns, indicators, and other technical analysis tools.

- Time management: Ability to effectively manage time and prioritize tasks.

C. Importance of a Solid Trading Plan

- A solid trading plan is essential for success in the stock market.

- A trading plan should include:

- Trading goals and objectives

- Risk management strategies

- Trading strategies and techniques

- Continuous evaluation and adjustment of performance

D. Tips for Managing Risk in Stock Trading

- Managing risk is an important aspect of successful stock trading, here are some tips:

- Diversify your portfolio

- Set stop-loss orders

- Limit your exposure to individual stocks

- Use proper position sizing

- Continuously evaluate your trades and adjust as needed.

Successful Traders in India

A. Overview of the Top Successful Traders in India

- India has produced many successful traders who have made their mark in the stock market. Some of the top successful traders in India include:

- Rakesh Jhunjhunwala

- Radhakishan Damani

- Mukesh Ambani

- Porinju Veliyath

- Ashish Chugh

B. Explanation of Their Journey to Success in the Stock Market

- Each of the successful traders listed above has taken a unique journey to success in the stock market, but some common themes include:

- A passion for investing and a deep understanding of the stock market

- Hard work and dedication to continuously learn and improve

- A focus on long-term investments rather than short-term gains

- A solid understanding of risk management and discipline in following a trading plan

C. Overview of the Strategies and Techniques Used by Successful Traders in India

- The strategies and techniques used by successful traders in India vary, but some common methods include:

- Fundamental analysis: Evaluating the financial health and potential of companies and their stocks.

- Technical analysis: Using chart patterns, indicators, and other tools to make informed trading decisions.

Earning Potential as a Beginner in Stocks

For someone starting out in the stock market, it can be difficult to predict their earning potential. A number of factors such as market conditions, investment strategies, and personal circumstances can have a significant impact on earnings. However, it is important to remember that the stock market has the potential to offer substantial returns, particularly over the long term.

One of the key factors affecting earnings in the stock market is the size of the investment. For beginners, it is recommended to start small and gradually increase investment over time. This not only helps to minimize risk, but also provides an opportunity to learn and develop a deeper understanding of the stock market and the factors that drive returns. Additionally, developing a solid trading plan and staying disciplined in its execution can help maximize earnings. Another important factor to consider is diversification, spreading investments across a range of stocks or sectors can help to mitigate risk and potentially increase returns.

For those just starting out in the stock market, it can be tempting to try to make big returns quickly. However, it is important to remember that success in the stock market is often the result of a long-term approach. By starting small, gradually increasing investment, and staying disciplined in the execution of a well-designed trading plan, beginners can potentially increase their earning potential in the stock market. It is important to keep in mind that there is no guarantee of returns in the stock market, but with a solid approach, the potential for substantial rewards is there.

Conclusion

The stock market is a dynamic and complex industry, offering a wide range of opportunities for those seeking careers in finance and investment. Whether one is interested in becoming a stockbroker, financial analyst, or trader, it is important to have a solid understanding of the stock market, the various job roles available, and the skills and knowledge required to be successful.

It is also important to consider the earning potential and the various factors that can impact returns, such as market conditions and personal circumstances. However, with the right approach, the stock market has the potential to offer substantial rewards, particularly over the long term.

In conclusion, the stock market is a constantly evolving industry that requires ongoing learning and growth. For those seeking a career in the stock market, it is important to be proactive in developing the skills and knowledge required to succeed, and to approach the market with discipline, patience, and a solid trading plan. The potential for rewards is there, and for those willing to put in the time and effort, a successful career in the stock market can be within reach.

For more such awesome and interesting content don’t forget to follow us, i.e. inveshares.com right here!!