Introduction : Stock Market Myths

In the fast-paced world of the stock market, myths and misconceptions often circulate, affecting how people approach investments and financial decisions. As seasoned Stock market specialists and professional traders, we have delved into the depths of stock market knowledge to bring you this comprehensive guide that aims to debunk seven prevalent stock market myth and reveal the shocking truths behind them. Our goal is to provide you with valuable insights, helping you make informed decisions and navigate the complex world of stocks. So, let’s dive in and separate fact from fiction!

Myth 1: Stock Market is a Gamble

Truth: The Stock Market is Not a Casino

One common myth is that investing in the stock market is akin to gambling. In reality, the stock market is driven by a complex interplay of economic factors, company performance, and global events. While there is inherent risk, it is not a game of chance. Wise investors conduct thorough research, analyze data, and diversify their portfolios to mitigate risks.

Myth Debunked: The Stock Market is Not a Casino

Let’s delve deeper into this myth and understand why the stock market is not a casino. This is a crucial distinction to grasp, as it can impact your investment decisions significantly.

The Role of Data and Analysis

In a casino, games of chance like roulette or slot machines rely on luck alone. In contrast, the stock market operates on data, analysis, and informed decisions. Investors use a variety of data sources, such as financial reports, economic indicators, and company performance data, to make investment choices.

Diversification Reduces Risk

In a casino, you bet on a single outcome, and the odds are largely against you. In the stock market, diversification allows you to spread your investments across different assets, reducing the risk associated with any single stock. This risk management strategy is not available in a casino.

Long-Term vs. Short-Term

Casino games are typically designed for short-term entertainment. In the stock market, the focus is on long-term growth and wealth building. Investors often hold stocks for years or even decades, while casino-goers seek instant gratification.

In summary, the stock market is a realm of opportunity and risk management, not a place of chance and luck. By conducting thorough research and making informed decisions, you can navigate this complex financial landscape successfully.

Myth 2: Timing the Market Leads to Success

Truth: Time in the Market Trumps Timing the Market

Some believe that timing the market perfectly is the key to success. However, attempting to predict market fluctuations is notoriously challenging. Historical data shows that staying invested in the market over the long term generally outperforms trying to time the ups and downs. It’s time, not timing, that builds wealth.

Myth Debunked: Time in the Market Trumps Timing

Let’s explore why time in the market is a more reliable strategy than trying to time market movements.

The Challenge of Market Timing

Timing the market involves predicting when to buy or sell assets to maximize gains and minimize losses. This is exceptionally difficult due to the market’s inherent volatility and unpredictability. Even seasoned investors and financial experts struggle with accurate market timing.

Long-Term Investment Success

Historical market data consistently demonstrates that long-term investors tend to achieve more significant gains. By staying invested over the years, you benefit from the market’s overall upward trajectory. Attempting to time the market can lead to missed opportunities and increased trading costs.

Emotional Toll

Market timing often requires making quick decisions based on emotions or short-term trends. This can lead to stress, anxiety, and impulsive actions. Long-term investors experience less emotional turmoil and are better positioned to withstand market fluctuations.

In conclusion, the evidence suggests that time in the market is a more dependable strategy for building wealth. By adopting a patient and long-term approach to investing, you can benefit from the market’s growth potential.

Myth 3: Only the Wealthy Can Invest

Truth: Anyone Can Invest in Stocks

Many think that investing in stocks is exclusively for the wealthy elite. This is far from the truth. With the advent of online brokerages and fractional shares, virtually anyone can invest in the stock market with a modest amount of capital. You don’t need a vast fortune to get started.

Myth Debunked: Stock Market Access for Everyone

Let’s shatter the misconception that stock market participation is reserved for the wealthy and explore how anyone can start their investment journey.

The Rise of Online Brokerages

The internet has democratized investing. Online brokerages offer user-friendly platforms that allow individuals to buy and sell stocks with ease. You can open an account, deposit a small sum of money, and begin investing in a matter of minutes.

Fractional Shares

In the past, buying a share of a high-priced stock might have been financially challenging. However, fractional shares now enable you to invest in a portion of a share, making it accessible even with limited funds. This innovation has opened doors for a more diverse range of investors.

Robo-Advisors

Robo-advisors are automated investment platforms that can help you create a diversified portfolio based on your risk tolerance and financial goals. These services are cost-effective and accessible to investors with various budget levels.

In summary, the barriers to entry for stock market investing have significantly lowered, making it feasible for anyone with a modest amount of capital to participate. You no longer need substantial wealth to begin your investment journey.

Myth 4: Day Trading is the Path to Quick Riches

Truth: Day Trading is Risky and Complex

Day trading is often glorified as a way to make quick profits. In reality, it’s a high-risk strategy that demands considerable time, knowledge, and emotional resilience. The vast majority of day traders end up losing money. Long-term investing, on the other hand, is a more reliable path to building wealth.

Myth Debunked: The Realities of Day Trading

Let’s examine the myth that day trading is a shortcut to quick riches and understand why it often leads to financial difficulties.

High-Stakes Gambling

Day trading involves buying and selling stocks within the same trading day. It’s a high-stakes endeavor that can lead to substantial gains or losses within a matter of minutes. The emotional toll and pressure to make quick decisions resemble gambling more than investing.

Emotional Resilience

Successful day trading requires a high degree of emotional resilience. Traders must manage stress, anxiety, and the fear of financial loss on a daily basis. Emotional decision-making can lead to impulsive actions and substantial losses.

Professional Knowledge

Day traders need in-depth knowledge of technical analysis, chart patterns, and market indicators. It’s a profession that demands constant learning and adaptation. Many aspiring day traders lack the expertise to navigate this complex field successfully.

In contrast, long-term investing is a more stable and reliable strategy. It allows you to benefit from the market’s overall growth without the stress and risks associated with day trading.

Myth 5: Stock Market Always Goes Up Over Time

Truth: Markets Experience Ups and Downs

It’s a common belief that the stock market always goes up over time. While the long-term trend tends to be positive, there are periods of volatility and bear markets. It’s crucial to be prepared for downturns and have a diversified portfolio to weather market fluctuations.

Myth Debunked: The Stock Market’s Ebb and Flow

Let’s dispel the myth that the stock market is a one-way path to riches and acknowledge the reality of market fluctuations.

Historical Volatility

Throughout history, the stock market has experienced periods of volatility and decline. The Great Depression, the Dot-Com Bubble, and the 2008 financial crisis are just a few examples of significant market downturns. These events serve as reminders that markets don’t always go up.

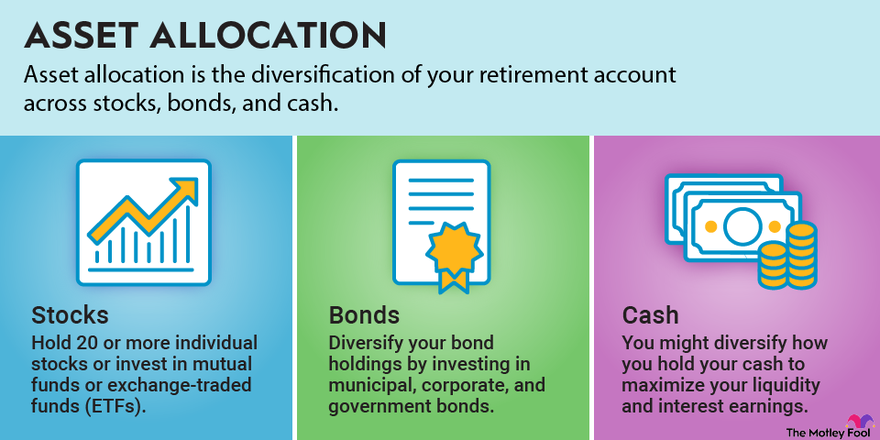

Diversification as a Risk Mitigation Strategy

Diversifying your investment portfolio by holding a mix of stocks, bonds, and other assets can help mitigate the impact of market downturns. When one asset class is struggling, another may be performing well, balancing your overall portfolio.

Long-Term Perspective

While short-term market fluctuations can be unsettling, a long-term perspective often reveals a positive trajectory. Investors who remain patient and committed to their financial goals are better positioned to benefit from the market’s growth potential over time.

In summary, acknowledging the market’s potential for ups and downs is essential for successful investing. Being prepared and having a diversified portfolio can help you navigate the ever-changing market landscape.

Myth 6: You Need a Financial Advisor for Every Investment

Truth: Self-Directed Investing is Viable

Having a financial advisor can be beneficial, but it’s not a prerequisite for successful investing. Many investors take a self-directed approach, using online resources and tools to research, buy, and manage their investments. With the right knowledge and discipline, you can manage your portfolio effectively.

Myth Debunked: The Viability of Self-Directed Investing

Let’s break the misconception that you need a financial advisor for every investment decision and explore the advantages of a self-directed approach.

Access to Information

In the digital age, investors have access to a wealth of information and resources online. You can research stocks, analyze financial reports, and stay informed about market trends without the need for a financial advisor. This accessibility has empowered many individuals to take control of their investments.

Cost Savings

Financial advisors typically charge fees or commissions for their services. By taking a self-directed approach, you can reduce costs associated with professional advice. This can have a significant impact on your overall investment returns.

Tailored Control

When you manage your investments, you have complete control over your portfolio. You can align your investment choices with your financial goals, risk tolerance, and preferences. This level of customization can be highly advantageous.

While financial advisors offer valuable expertise, a self-directed approach is a viable option for individuals who are willing to invest time in learning and managing their portfolios.

Myth 7: Stocks Are Only for Retirement

Truth: Stocks Are Versatile Investments

Stocks are not solely meant for retirement planning. They can be part of a diversified investment strategy for various financial goals, including buying a home, funding education, or simply growing wealth. The key is aligning your investment choices with your objectives.

Myth Debunked: The Versatility of Stocks

Let’s dispel the notion that stocks are exclusively for retirement planning and explore the various financial goals they can help you achieve.

Wealth Accumulation

Investing in stocks offers the potential for wealth accumulation over time. Whether your goal is to build a financial safety net, buy a home, or fund a dream vacation, stocks can play a crucial role in achieving these aspirations.

Education Funding

Many parents and guardians use investments in stocks to save for their children’s education. By starting early and using tax-advantaged accounts, such as 529 plans, you can build a fund to cover educational expenses.

Emergency Funds

While stocks carry risk, they can still be a component of an emergency fund. By maintaining a diversified portfolio that includes low-risk assets, you can access funds in times of unexpected financial need.

In summary, stocks are versatile financial tools that can help you achieve a wide range of objectives beyond retirement planning. The key is to align your investment choices with your specific financial goals.

Conclusion

In the world of stock market investments, myths can be misleading and even costly. By debunking these seven common misconceptions, we hope to empower you with the knowledge needed to make sound financial decisions. Remember, the stock market is a dynamic and ever-changing entity, and understanding its intricacies is the first step towards successful investing.

For more such awesome information, keep following InveShares.com right here!

FAQs

1. Are stocks really a safe investment option?

Stocks carry a level of risk, but they can be a safe and profitable investment when approached with research and diversification.

2. Is it possible to time the market for short-term gains?

Market timing is extremely challenging and often leads to losses. Long-term investment tends to be more reliable.

3. Do I need a significant amount of money to start investing in stocks?

No, you can start investing with a modest amount thanks to online brokerages and fractional shares.

4. What’s the biggest risk in day trading?

The biggest risk in day trading is the potential for significant financial losses due to market volatility.

5. Can stocks be a part of financial planning beyond retirement?

Absolutely. Stocks can be a versatile tool for various financial goals, not just retirement planning.